Risk and reward are related

Evidence from investors and academics points to one undeniable conclusion: returns come from risk. Investment rewards are rarely accomplished without taking a risk, but not all risks carry a reliable reward. Everything we have learned about expected returns in the equity markets can be summarised in three dimensions:

Shares are riskier than bonds. In turn they offer higher expected returns as a reward.

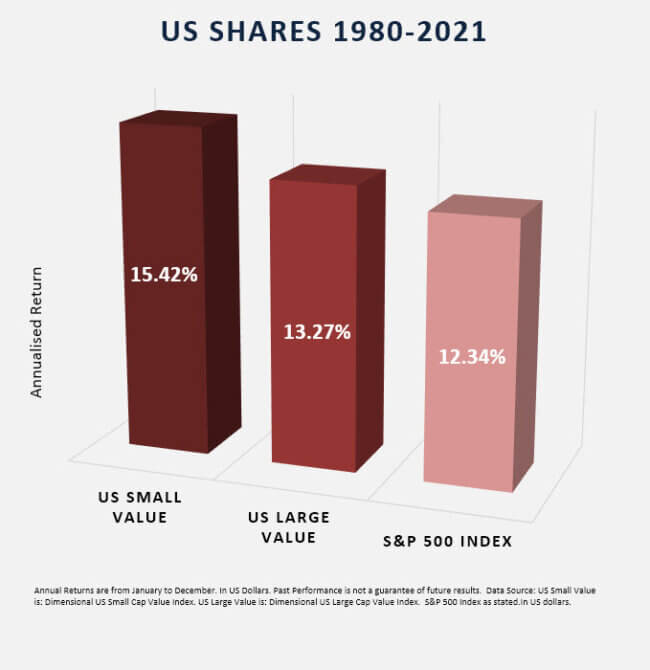

Small companies have higher expected returns than large companies. This makes sense because small companies are more of an unknown quantity.

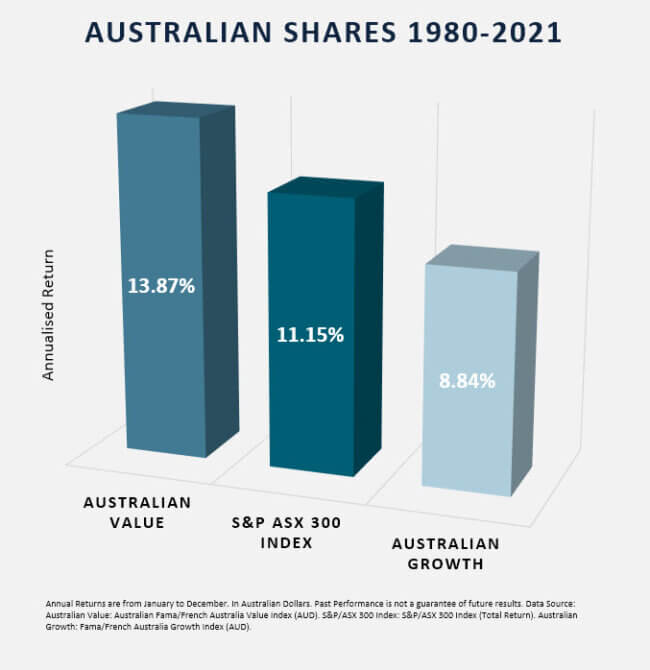

Lower priced ‘value’ stocks offer higher expected returns than higher priced ‘growth’ stocks. A value stock is one that is out of favour for one reason or another. The level of exposure to these areas will determine the risk and reward.

These charts show the benefit of risk premiums over various time periods. Illustrating while we might want to invest in great companies, the most successful companies aren’t always the best investment.

In Australia, this chart shows the benefit of risk premiums afforded to the value index over the last 40 plus years.

And over a longer time frame, this US chart shows how small risk premiums have delivered

The small and value premiums are not always present, that’s why they are called ‘risk’ factors. However, as the charts show, they are more likely to be rewarded. And they are available to investors if they stay disciplined over the longer term.

At Foundation Wealth Planners we understand the risks worth taking.