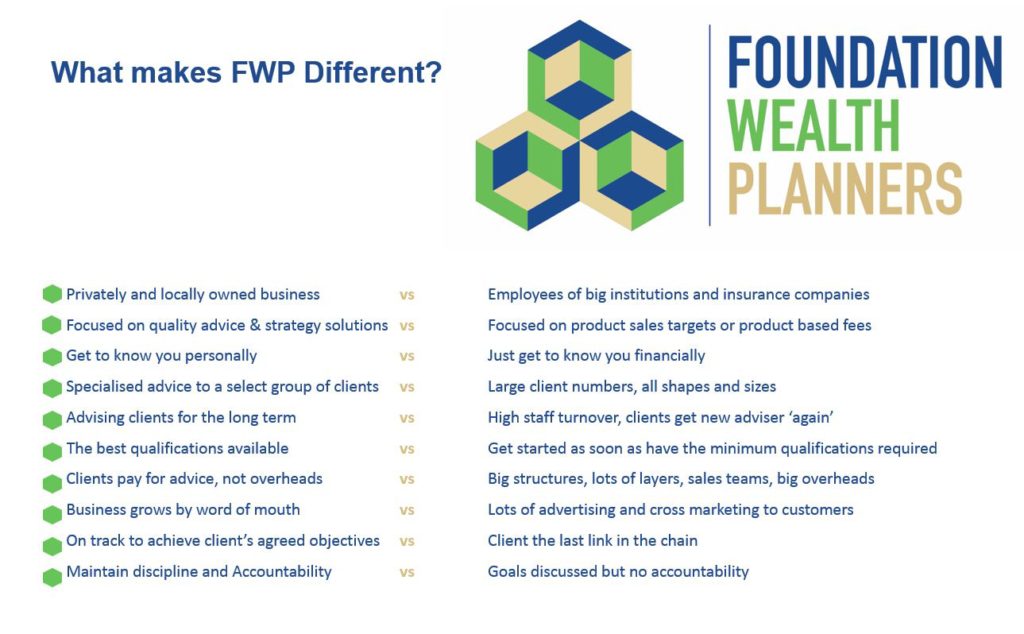

Not All Financial Planners Are The Same

As many investors have found out in recent years, biggest isn’t always best. A large financial institution with a high profile may signify safety and security, but in reality there’s only one connection between your financial position and the financial security of that institution – their large profits are underpinned by the fees you pay.

Your financial future is important at FWP.

A bank, for instance, is vertically integrated. A financial planner in a bank branch is usually a salesperson for insurance and financial products designed and owned by that bank. The financial planner derives a commission from putting a client into bank insurance and managed funds. And often the management fees on those products are higher than many others available.

The bank’s financial planner wins because he gets the commission and the bank wins because the client is pushed into the bank’s own higher fee products.

Unfortunately, it’s the client who loses.

FWP financial planners aren’t institutional financial planners with sales targets to meet. We don’t exist to sell you products or push specific funds or investments.

That means you are our focus.