Government support for retirees in response to COVID-19 & market volatility

What is changing?

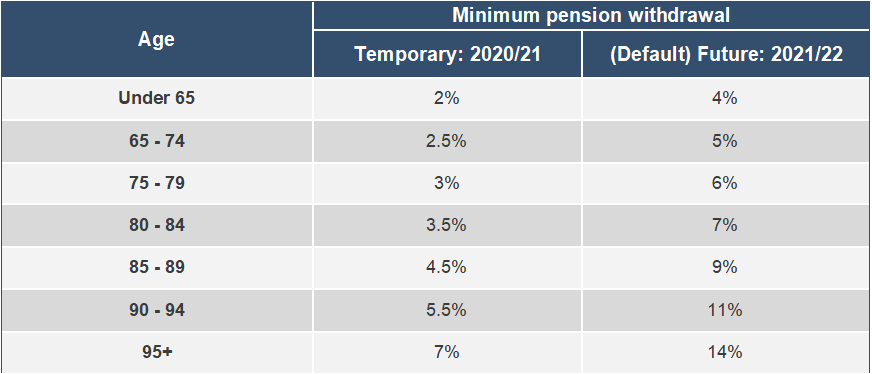

The Government has temporarily reduced superannuation minimum pension withdrawals for account-based pensions by 50 per cent for the current financial year.

Why the change?

The intention is to offer retirees flexibility during this period of market volatility. Retirees have the ability to leave more of their retirement savings invested and not draw upon assets after a decline in value. This change was also put in place during the 2008 global financial crisis for similar reasons.

Annual payments are calculated on the account balance at July 1.

Example

If you have $500,000 in an account based pension and you were 70 years old, previously you would have been required to draw 5% or $25,000. In 2020/21 the minimum would be 2.5% or $12,500.

Who can benefit?

The major beneficiaries of this change will be those retirees who are either flexible with their spending, or alternatively have other assets outside the superannuation environment they can draw upon. If a retiree had certain spending plans (such as travel) that have been affected by COVID-19, it offers the opportunity to leave investments in place and not draw down. As lower account valuations may now mean higher Centrelink payments for many people, there may now be an opportunity to commensurately reduce drawings from account based pensions.

As always, discuss all strategy options from legislative amendments with your adviser.