Federal Government has handed down the Budget for 2015-16. As foreshadowed, the Budget contained few surprises with a number of announcements made in the previous weeks.

Here’s our overview of areas of interest, as always it is important to note that the Budget announcements are still only proposals at this stage. As you may remember many proposals from last year’s budget are still proposals after they still haven’t passed the Senate!

Superannuation

Early access to superannuation for people with terminal illness: Amending superannuation conditions of release making it easier for people suffering a terminal illness to access their superannuation benefits from 1 July 2015. Under current rules, a person with a terminal illness can only access their preserved super benefits when they are diagnosed as having less than 12 months to live. The Government plans to amend the relevant regulations to change the life expectancy period to 24 months. This change will provide people with access to their superannuation earlier which may assist with the payment of treatment and allow them to make the most of time with their family.

Lost and unclaimed superannuation: A reduction of red tape for superannuation funds and individuals. The changes include removing redundant reporting obligations and streamlining lost and unclaimed superannuation administrative arrangements. The government says the changes aim to make it easier for individuals to be reunited with their lost and unclaimed superannuation.

Personal Tax

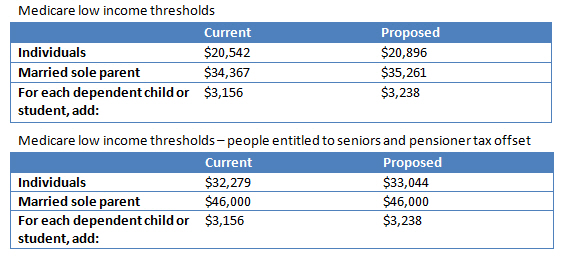

Increasing the Medicare levy low-income thresholds: The Government will increase the Medicare levy low-income thresholds for singles, families and single seniors and pensioners to take into account of movements in the Consumer Price Index. Taxpayers with taxable income below this threshold are exempt from paying Medicare Levy. These changes are to apply from 2014-15.

Business Tax

Tax incentives for small business: The Government announced a range of tax concessions to assist small business entities. Generally, a business is a small business entity if it has business turnover (aggregated turnover) of less than $2 million.

Company tax cuts: A tax cut of 1.5% is proposed to apply to all incorporated small business entities from the 2015-16 financial year. If implemented, this measure will reduce the company tax rate for small business entities to 28.5%.

Importantly, the Government has confirmed the current maximum franking credit rate of 30% will remain unchanged for all companies, maintaining the existing arrangements for investors, such as self-funded retirees.

Pensions, Allowances & Concession Cards

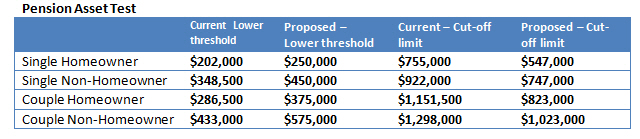

Pension asset test changes From 1 January 2017, the following changes to the pension asset test have been proposed:

• Increase the ‘asset free areas’ for both homeowners and non-homeowners • Increase the asset test taper from $1.50pf to $3pf per $1,000 of assets over the lower threshold.

According to the government the proposed changes will result in some people either completely losing their age pension entitlement or having their entitlement to a part pension reduced. Conversely, other people may see a small increase to their entitlement.

For example, the government has forecasted approximately:

• 91,000 will lose entitlement to the pension

• 235,000 will have their pension reduced

• 170,000 will receive a pension increase.

Asset free area changes: The proposed changes to the asset free area (the lower assets test threshold) are:

For those with lower levels of assets, these changes may result in an increased rate of age pension. The government has also confirmed the comparatively larger increase in the lower assets test level for non-homeowners is in recognition of higher living costs.

Under these proposed changes the asset test taper rate will return to 2007 levels and will result in a substantial reduction in the upper assets test threshold.

This table sets out the current and proposed asset test thresholds:

Concession cards: The government estimates that approximately 12% of pensioners will lose entitlement to the pension as a result of the changes to the asset test. These people will automatically be issued with a Commonwealth Seniors Health Card, or a Health Care Card for those under pension age.

Previously announced changes to income test free areas and deeming thresholds: Due to the changes in the pension asset test, the government will not proceed with changes to the pension income test free areas and deeming thresholds that were announced in the 2014 Federal Budget. It was previously announced that the Government would freeze indexation of the pension income test free area for 3 years from 1 July 2017. In addition, deeming thresholds were proposed to be reset from 20 September 2017 to $30,000 for singles and $50,000 for couples.

Aged Care

Rental income to be included in aged care means tests: New aged care residents who enter aged care from 1 January 2016 will have their rental income from renting out their former home included in the calculation of their means tested amount. This differs from current rules, where residents who pay some or all of their accommodation payments as periodic payments are entitled to an exemption on the rental income from their former home when calculating their means tested amount for aged care fee purposes.

The Government claims this measure aligns the aged care means testing arrangements between those that pay their accommodation payments as lump sums and those that pay periodic payments.

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation and individual needs.