Economic Overview

The world held its breath as it entered the first quarter of 2021. Despite hoping for a peaceful transition from President Trump to President-elect Biden, the US Capitol Building was stormed by supporters of President Trump on January 6. The havoc saw five people die, including a Capitol Police officer. In the wake of the violence, President Trump elected to bypass President Biden’s January 20 inauguration and there were lingering concerns of civil unrest. Thankfully, the Inauguration was uneventful.

With the US political environment slightly more subdued, attention turned to the eye watering stimulus. The stimulus at the end of 2020 ($900 billion) combined with the early March relief package ($1.9 trillion) equate to almost 14% of US GDP. The American Jobs Plan announced on the last day in March proposes a further $2.25 trillion in spending. This is aimed toward improving transportation, communication, and power infrastructure. The full extent of stimulus will be determined by what passes US Congress, but such spending is unprecedented and larger than what markets expected as 2021 began. The Biden administration has suggested hiking the corporate tax rate to 28% from 21% to fund the infrastructure plan.

To understand the thinking, after the Great Depression the US passed a series of infrastructure bills designed to boost the economy and create jobs. This led to projects like the Hoover Dam and Golden Gate Bridge being completed. However, it is worth noting, during the 2008 financial crisis, the US passed two spending plans totaling $983 billion, already dwarfed by the COVID stimulus response.

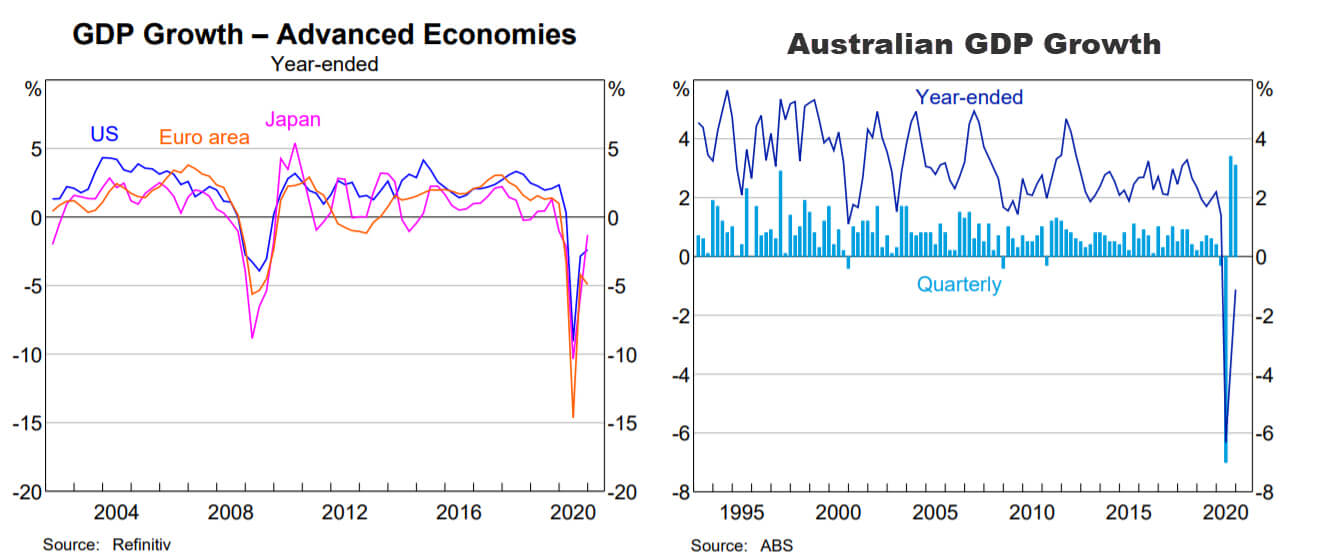

Source: RBA 2021

On the COVID-19 front, it was estimated more than 150 million vaccine doses had been administered in the US by quarter end. An average of 2.8 million doses were administered daily. Globally, more than 590 million doses had been administered by quarter end. US Federal Reserve Chairman Jerome Powell reiterated the central bank is wholly committed to supporting the recovery by keeping interest rates low and supporting the bond market. Powell made it clear to the House Committee on Financial Services that substantial progress will need to be made before any changes, which will be made with transparency.

In the European Union, data reflected the uneven reality of the recovery. Annual inflation was confirmed at 0.9% for January with GDP down by 0.6% in Q4 2020, as the German economy grew by 0.1% in Q4 2020, while French GDP shrank 1.3%. The European Commission’s consumer confidence survey fell by 1.7 points in January, but the flash manufacturing purchasing manager’s index (PMI) for March hit a record high of 62.4, signalling strong growth. However, rising COVID infection rates and new lockdown curbs across some countries cast doubt on the prospects for service sectors, including tourism. Sentiment was hit early in the quarter by political turbulence in Italy leading to the resignation of Prime Minister Conte, but the parliament soon approved the formation of a new government, led by former European Central Bank chair Mario Draghi.

Unfortunately, in contrast to the fast pace of vaccinations in the US, only 10% of the EU’s total population have received 1 vaccine dose, and only 4% have completed a full vaccine series. By late February, new weekly cases in Europe fell below 1 million, but had climbed above 1.6 million new cases in the last week of March.

In the UK, the roll-out of vaccines picked up speed but economic activity was again tempered by lockdown restrictions. After a 2.9% fall in GDP in January, there was a slight recovery in February with 0.4% growth. Overall, consumer-facing service industries are still well below pre-pandemic levels. The IHS Markit/CIPS composite purchasing managers index rose in March to 56.6, which was seen as a positive as lockdown measures eased towards the end of the quarter.

In Japan, the first regulatory approvals for vaccine rollouts were granted in mid-February, with the first batch of Pfizer vaccines going to frontline medical workers with those over 65 to follow. However there has been frustration with the languid speed of the rollout, with some Japanese economists and business owners suggesting it puts the recovery at risk. Despite this, the Suga government has declined set any long-term targets on vaccination.

It appears the Tokyo Olympics will be held, although the government confirmed there will be no international spectators in attendance.

China, miraculously, was the only country to post a GDP gain in 2020, expanding at 2.3%, the slowest pace in more than four decades. Year on year foreign trade was up 29.2% in Q1, however Q1 foreign trade was down on the previous quarter. While the trade war might be over between China and the US, the US placed a ban on Chinese cotton and tomatoes (and associated products) from the Xinjiang region. This is due to human rights violations and the widespread use of forced labour in the region.

Emerging market economies were mixed over the quarter, with COVID-19 dictating the play. Daily cases are at new highs in Brazil with hospitals in several regions of the country near capacity. Poland has seen a third wave, as daily cases reach all-time highs, while India also saw a recent spike in new cases. At the same time, new daily cases are falling in Russia and South Africa. With the Q4 2020 GDP numbers released, it showed a strong recovery in play. This can be attributed to manufacturing and commodities, underpinned by strong foreign demand. Internal consumption also recovered faster than expected in Latin America, as lockdowns were eased.

Back in Australia, data showed employment had recovered to around half a percent below pre-COVID levels, as stimulus payments were wound back. Acknowledging this, the RBA suggested the end of the JobKeeper program was unlikely to have a material impact as many firms had already adjusted their workforces and labour demand was picking up, as evidenced by job ads. House prices again featured during the quarter. With borrowing rates at extreme lows, house prices were rising at the fastest pace in 32 years according to CoreLogic. Many economists and financial pundits wondered if it was time for regulatory intervention. The chair of the prudential regulator Wayne Byers offered that APRA were watching closely, but there was no cause for alarm.

As with other economies, the vaccine rollout came into sharp focus during Q1. the AstraZeneca vaccine, the Australian government’s primary option, was approved by the Therapeutic Goods Administration during the quarter. At the same time, reports started to emerge of blood clotting in AstraZeneca recipients, this led to some countries suspending its use.

Market Overview

Asset Class Returns

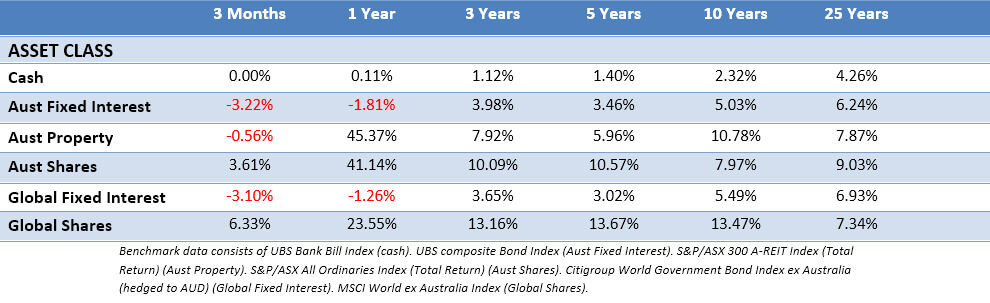

The following outlines the returns across the various asset classes to 31st March 2021.

Sharemarkets around the world were mostly positive in Q1, with the majority of investment pain being felt in the bond market. Bond prices fell with yields rising sharply due to the strength of the US & UK vaccination rollout and further expectations of US stimulus. The 10-year US Treasury yield moved from 0.91% to 1.74%. The UK 10-year yield increased from 0.23% to 0.88%.

There was a mild bout of volatility in late February due to concerns that a swift recovery would force an increase from the US Federal Reserve earlier than expected. Energy, financials and industrials made strong gains in the US. The Dow (+6.8%) and S&P 500 (+4.7%) saw their best month since November, with each benchmark hitting new highs. The Nasdaq 100 lagged with a modest gain of 0.5% in March, as growth stocks were pressured by the movement in the bond market.

European equities advanced in Q1. Expectations of a global economic recovery lifted sectors that fared poorly in 2020, such as energy and financials. Consumer discretionary companies also performed well, while car makers saw a lift as Volkswagen announced ambitious electric vehicle targets. Defensive areas, less tied into the economic recovery, such as utilities and real estate underperformed.

UK equities performed well. With lower priced, economically-sensitive areas of the market continuing their recovery. As with Europe, this came with a strong performance in materials, energy and financials. Banks performed particularly well amid better-than-expected results and a sharp increase in bond yields as the global economic outlook improved.

Japanese equities continued their rally with the corporate profit recovery. Sentiment was also helped as the yen remained weak against the US dollar. Like elsewhere the Japanese market was led by cyclical sectors and lower quality, value style companies.

Across the rest of Asia, sentiment weakened towards the end of the quarter as slower vaccination rates led to the reintroduction of lockdown restrictions in some countries. The best performing markets were Taiwan, as the IT sector strengthened and Singapore, where financials supported returns. The Philippines was the weakest market, a sharp rise in daily new cases of coronavirus resulted in tighter restrictions, weighing on the outlook for the services-oriented economy.

Emerging markets registered a positive return in Q1, backing up their strong Q4 2020 performance. Chile was the best performing market due to the strong copper price and a positive start to their vaccine roll-out. Turkey was the weakest market with instability coming from the unexpected replacement of the central bank governor. China also finished in negative territory with regulatory uncertainty for certain and ongoing geopolitical concerns dampening sentiment.

The Australian market posted 3.61% return for the quarter with the strongest performers being financials, communications services and consumer discretionary as real estate picked up and the economy continued to open up and consumers moved about. Health care, industrials and consumer staples were the laggards.

A Year On…

Last year, in the first quarter of 2020, things became very hairy. As the markets started tumbling, we had no idea where they might go, or how heavy the falls would be. Turns out, the falls were very heavy, but very brief. At the time, we wrote a lot of words and communicated with you on a regular basis. The idea is always to keep you in your seat with a long-term view that aligns with your goals and plan. The following is just a paragraph, but it was emblematic of the thousands of words we wrote at the time:

The virus will likely get worse. Then it will likely better. Central banks will intervene. Governments will likely spray some stimulus. Economies will spike as demand returns. Markets will recover as the American election cycle hurtles towards a conclusion. Australia’s economy will remain sluggish. US Corporate profits will continue. People who ignore things will sail through. Those who panic and sell will regret it later.

And it was pretty close to how things played out. We’re not looking to take credit for any successful forecasts because that wasn’t a forecast. It merely an expectation of reality. We’re optimistic about the future. It won’t always be perfect or without challenge, but no matter the crisis, it will be addressed on every front. History has repeatedly shown this to be the case. The future has always been better than the past.

Optimists are rewarded as investors. Human progress is regularly distilled into gains and dividends via share markets. Have a strategy tailored to you, be broadly diversified, and remain invested. As advisers we’ve seen retirements and lifestyles financed, children educated, and wealth passed down through generations. None of this happened through losing faith in markets, chopping and changing strategies on a whim, or being spooked by forecasts of perpetual doom.

It has always been the case that building wealth in investment markets required an optimistic outlook.

This will never change.