Economic Overview

Interest rates and inflation were again major themes in Q4, as the US Federal Reserve delivered a hawkish message to round out the year following its December meeting. This capped off a year dominated by inflation. Inflation figures in many developed economies hit the highest levels since the early 80’s. The high figures saw some very aggressive monetary policy in response, but there were signs the hawkish messages and aggressive rate moves may have started to have their intended effect. Inflation appeared to cool in some countries towards the end of 2022, most notably in the US. Financial markets showed reasonable performance in Q4, the ASX All Ords notched a strong gain while global markets were also up, however it wasn’t enough to offset a negative 2022 in both cases.

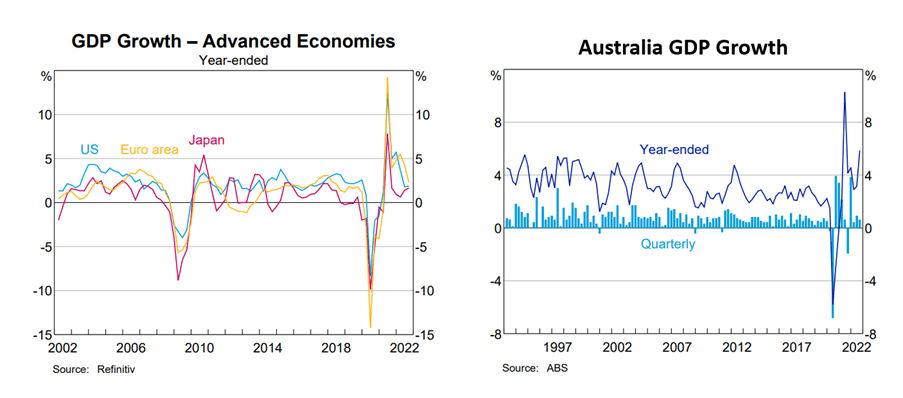

In the US, Q3 GDP figures released in December came in at 3.2%. This was stronger than estimates, and a bounce back after two straight quarters of contraction. Inflation remains elevated, coming in at 7.1% year on year in November, but this was down from 7.7% in October. Unemployment remains at 3.7% with 263,000 jobs added in November for a total of 4.3 million net new jobs ending November, but there are still 1.7 job vacancies for every person looking, ensuring hiring remains a challenge. Consumer spending has underpinned the economic recovery following the pandemic, but retail sales in the US declined 0.6% month-over-month in November of 2022. The biggest decline seen in 2022. The Fed’s final rate hike of the year was pared back to a 0.5% increase, after four consecutive 0.75% increases. Given the Fed’s late year comments, it’s expected more rate hikes will come in 2023. Real-time tracking estimates for Q4 growth indicate expansion around 2.7%, based on late December data.

Source: RBA 2023

In the Eurozone, inflation fell to 10.1% in November from 10.6% in October. The ECB raised interest rates by 0.5% in December, slowing from the previous 0.75% hikes. This brought the policy rate to 2%. ECB President Christine Lagarde also warn that the central bank was “not done” on this front. The Eurozone economy grew by 0.3% quarter-on-quarter in Q3, slowing from 0.8% in Q2. The composite purchasing managers’ index PMI for December was 48.8, up from 47.8 in November, but a reading below 50 still indicates contraction. The positive, for a region suffering an energy crisis, was seeing gas prices fall. Unseasonably mild weather for the period helped reduce gas cost pressure.

In the UK, a new quarter meant another new Prime Minister. Rishi Sunak was appointed leader of the Conservative Party, making him the new UK Prime Minister. Sunak’s prior experience as chancellor, along with the abandonment of policies announced in the September “mini-budget” by the previous leadership team helped to stabilise UK markets, which, along with the pound, had been in chaos due to the proposed tax cuts funded by borrowing. New chancellor Jeremy Hunt promised the country would tighten its belt in response. The Bank of England increased rates as anticipated, by 0.75% in November and 0.5% in December. The final inflation figure for the quarter sat at 10.7%, down 0.4% from the previous month.

In Japan, The Bank of Japan announced a change in yield control policy. Essentially, they are no longer against increasing yields on long-dated government bonds. This was viewed as significant by global investors. Japan has a reputation for being the only developed economy with very loose monetary policy. Bank governor, Haruhiko Kuroda, denied the move represented a tightening of policy, but markets disagreed. The Yen strengthened by 4% immediately after the announcement and Japanese stocks experienced sharp falls. Data showed that inflation hit 3.7%, the highest level since the 1980’s. The government put in place an additional fiscal package in Q4, which aims to bolster a domestic recovery in 2023.

In China, early in Q4 it was announced Premier Xi Jinping would remain in power for another five years, as the “Zero Covid” policy looked to be extended. Both were seen as negatives, however by November there was a reversal by the Chinese government on the Covid front. Following continual public unrest at lockdown restrictions, policy makers announced the immediate removal of the strictest restrictions. Despite the initial (and expected) spike in cases as a result in December, it was announced borders would reopen to international visitors in January 2023. There was also an easing of geopolitical tensions, as both Xi Jinping and US President, Joe Biden, expressing that they would like to improve relations. As expected, there was a decline in both manufacturing and services output during the period.

In Emerging Markets, the weaker US dollar during Q4 was supportive, but optimism faded in December when the US Fed re-iterated its commitment to fighting inflation. In Turkey the central bank loosened monetary policy as interest rates were cut to 9% in November, but in a country where inflation topped 85% in October, the central bank announced that would be the end of the current easing cycle. Macroeconomic data in India and Taiwan was mixed, while policy uncertainty clouded the outlook in Brazil after President Lula’s election in October.

Back in Australia, data released in December showed GDP increasing by 0.6% for Q3 2022, with the economy growing by 5.9% year on year, reflecting the economy is quite strong. Household consumption accounts for around 55% of GDP, but household consumption growth is falling. The savings rate fell to 6.9%, some called this a normalisation, as the savings rate is now back around pre-covid levels. All this should be expected, as monetary policy from the RBA has been quite aggressive. While interest rates are still historically low, they have moved sharply higher from a record low base.

On that front, annual inflation for Q3 came in at 7.3%, the highest inflation reading since 1990. Despite increasing inflation, the RBA slowed its rate increases from 0.5% as they’ve been each month in Q3, to 0.25% for each month of Q4. Even so, that totalled eight consecutive interest rate rises, which brought the cash rate to 3.10%. The quick upward move from 0.1% was again felt in the property market. In its December statement, the RBA said it expected inflation to increase in the months ahead, but decline next year.

Rate increases were being felt in the real estate market, according to data from Corelogic. As of December 31 the combined capital city index was down -3.3% for the quarter and -8.6% from the peak seen in mid May 2022, which came two weeks after the RBA’s first interest rate rise. Sydney was down -12.7%, Melbourne -8.3%, Brisbane -9.2%, and Hobart -9.3% since peak. While Adelaide -1.3% and Perth -0.6% were more resilient. The combined regional index was down -6.6% since its peak in June.

Market Overview

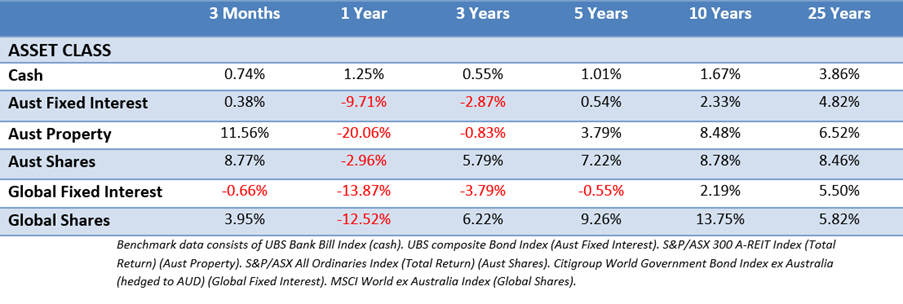

Asset Class Returns

The following outlines the returns across the various asset classes to 31 December 2022.

Global sharemarkets were positive in Q4, with the Australian market quite strong, while Australian listed property attempted to recover lost ground. Asian markets were boosted by China’s relaxation of its zero-Covid policy, while European equities also advanced strongly and were the strongest performer of the major regions. Overall, it was still a negative year, despite the better performance in the second half and final quarter. Bond prices were more subdued in Q4 as yields settled into a tighter range than seen earlier in the year. The 10-Year US Treasury yield finished almost flat for Q3, moving from 3.83% to 3.88%, with 2-year yields rising from 4.22% to 4.42%. In the UK, the 10-year yield slipped from 4.09% to 3.67%, while the Australian 10-year yield moved from 3.91% to 4.04%.

US shares saw mid-single-digit growth in October and November, but December saw a sell off with the markets suffering in the last few weeks of the quarter. Most sectors rose over the quarter, with a number climbing significantly. Energy stocks posted especially strong gains, as sector heavyweights Exxon and Chevron posted record profits in the quarter. Consumer discretionary was a notable exception, with Tesla’s ongoing decline a major influence. S&P 500 earnings grew at a projected 8%, boosted by significant earnings growth in the energy sector. Excluding energy, S&P 500 earnings fell by 1.8%. While company revenues were increasing, higher input and interest costs have put pressure on margins.

Eurozone shares saw strong gains in Q4, outperforming other regions. Economically sensitive areas like energy, financials, industrials and consumer discretionary were the big winners, while more defensive areas such as consumer staples lagged the wider market’s advance. Gains were supported by hopes that inflation may be peaking in Europe, as well as in the US. Tailwinds also emerged as milder weather eased concerns over energy shortages. French and German markets saw gains of 12.8% and 14.8% respectively.

UK shares saw strong gains in Q4, helped by the appointment of a new PM and chancellor who steadied the ship and helped the UK move on from the crisis of the previous team. The FTSE 100 and the FTSE All-Share Index were both up over 8% for the quarter. By sector, there were very strong gains from basic materials 16.8%, healthcare 12.4%, utilities 12.4%, consumer discretionary 11.8%. The only notable laggard was telecommunications, down nearly 10%.

In Japan, the market saw gains in October and November before declining in December. All up, the total return for Q4 remained positive, at 3.3% in yen terms. Most Japanese companies reported Q3 earnings in November. Results were quite strong and stronger than expected, particularly for larger companies benefiting from yen weakness. The level of confidence among management teams was highlighted by a record level of share buybacks being announced.

Asia (ex-Japan) and Emerging markets, Chinese shares were quite volatile as the quarter began with a sharp sell-off in Chinese and Hong Kong markets as investors digested the news of Xi Jinping would remaining in power and ongoing “Zero Covid” policy. When the Chinese government relented on Covid restrictions the Shanghai Composite and Hang Seng saw significant rallies through to the end of December. In contrast, Taiwan shares had a strong move upward in November, but flatlined over higher US interest rates and lower demand for electronic goods, one of Taiwan’s biggest exports. Thailand, the Philippines and Singapore were also strongly positive. The Middle East markets underperformed, impacted by weaker energy prices. Qatar and Saudi Arabia being major laggards. Indonesia was also negative, while India struggled as macroeconomic data was mixed. Poland and Hungary rebounded following months of underperformance due to the war in Ukraine.

The Australian market (All Ords Accumulation) was up nearly 9% in Q4 due to a strong rally through October and November, but spent most of December going backwards, as US interest rate concerns flared again. Utilities were the strongest performer, up over 26%, and jumping significantly in response to a takeover offer for Origin Energy in November. Materials were also a strong performer, up nearly 15%, as the bigger miners shrugged off the December sell off seen across the broader index. Consumer discretionary and consumer staples were flat, while industrials were up 6%.

The Ebb and Flow

If you’ve gotten this far, congratulations. Quarterly updates are something every financial business seems to do, and every quarterly report seems to be relatively similar. We know they’re not the most exciting thing we send out. We get feedback on our regular blog posts, but no one ever comments on these quarterly updates. We understand why. They’re dry, boring and data heavy. They’re just a recap of things that have already happened, and they’re old news.

Yes, they are easy to glaze over and skip past, but we’d encourage everyone to look at them from a different way. They are a very brief summary of economic matters and financial market movements that occurred over a three month period across the world. This quarterly is far from exhaustive, but take note of the sheer number of events that occur, along with how many pieces of financial data, and information are constantly being released.

All these things are swallowed by financial markets, digested, and priced in daily, but more often on a minute-by-minute basis. Markets don’t always swallow, digest, and price information the way we expect. Good can be bad, and bad can be good, leaving investors scratching their heads.

How do we get an edge as investors? We can’t. Again, note all the events and financial information and data that are noted in this quarterly, it’s merely a handful from across the quarter. Markets price it all in and move on quickly. To become a better investor, we all must accept we can’t get ahead of these things no matter what our opinions are. The alternative is guessing and hoping we’ve made the right guess.

Not a great strategy. Remember, every quarterly is a good refresher of how much information is out there influencing market movements.