Economic Overview

Q4 was a very positive end to the year, and despite the gloomy outlook many had for 2023 it was a fruitful one for investors who maintained a bias towards growth in their portfolios. Inflation continued to moderate in the US, while economic growth held up, continuing to defy any recession forecasts. Despite energy inflation looming as a worry during Q3, due to production cuts coming from Saudi Arabia and Russia, crude oil prices fell in Q4. Notably, and to the surprise of many, the US hit a record for oil production in November, and is estimated to have added an additional 1.2 million barrels per day of production in 2023. Sharemarkets were strong across the board in Q4. Australian shares saw a high single digit return for the quarter, rounding out a low double-digit gain for the year, while unhedged global markets punched out a mid single figure return for the quarter, to finish with a return in excess of 20% for 2023. Bonds also had a strong quarter, with yields falling and prices up, this rounded out the first respectable calendar year return for the asset class in some time.

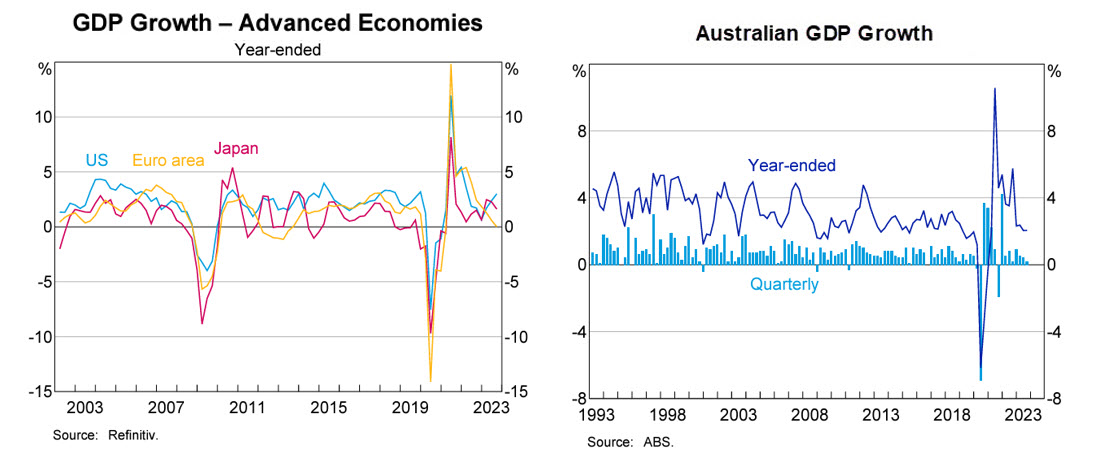

In the US, GDP grew at an extremely hot annualised rate of 4.9% in Q3 2023, this was significantly up from the Q2 figure of 2.1%, and the strongest figure since Q4 2021. Real-time GDPNow tracking showed the US economy wasn’t as strong in Q4, but forecast to come in near 2.3%. The sharp increase in Q3 GDP was driven by consumer spending, contributing 2.11%, while private investment was also strong, adding 1.74% to the GDP number. Government spending added 0.99% to GDP, with increases in expenditure across all levels of government.

Annual inflation slowed from 3.7% in September to 3.2% in October and 3.1% in November. The Federal Open Market Committee also left rates unchanged for the third consecutive time during its December meeting, keeping the federal funds rate at a target of 5.25% to 5.50%, but it was the dovish tone which helped light up equity markets in Q4. Minutes from the meeting showed policymakers expect rates to end 2024 at 4.5%-4.75%. Fed chair Jerome Powell indicated that the central bank was aware of the risk of keeping rates too high for too long. This dovish pivot was in contrast to the message conveyed from Q3 where the FOMC signalled its intent to keep rates elevated for longer than anticipated.

US oil production hit a record high of 13.2 million barrels per day in the quarter, while US natural gas production was also near its all time high throughout the quarter. The US now exports more oil than any single country in OPEC. It’s an interesting outcome because the Republican side of politics in the US has implied President Biden was planning to kill off the US oil industry due to a suspension of oil and gas leasing on public land and offshore, which led to a belief US oil production was dying off. On the flipside, the Democrat side of politics, and President Biden’s Whitehouse, haven’t given much attention to the record oil production numbers, presumably because it contradicts their messaging on green energy and the environment.

Finally, on the housing front, the National Association of Realtors Housing Affordability Index, a noted measure of home buying affordability, is near its lowest level since 1985. The increase in interest rates has seen the average mortgage payment now over 50% higher than the average monthly rental payment. This has pushed buyers out of the market and into rentals, pushing rent prices up, with rents for single-family homes increasing more than apartment rents in 2023. In another grim stat, the number of homeless individuals in the U.S. has reached historic levels.

In the Eurozone, interest rates continued to weigh on the economy. Eurozone GDP fell by -0.1% quarter-on-quarter in Q3. This followed two consecutive quarters of 0.1% growth and one of -0.1% contraction, leaving the Eurozone economy near flatlining across the past 12 months of available data. The positives were household consumption increasing by 0.3%, while public spending also increased by 0.3%. Euro area annual inflation fell to 2.4% in November from 2.9% in October. The ECB held rates across Q4 at 4.5%. Among the Eurozone’s largest economies, Germany -0.1%, France -0.1%, and the Netherlands -0.2%, all saw falls in GDP, while both Spain and Italy saw growth at 0.3% and 0.1%, respectively. The flash eurozone purchasing managers’ index (PMI) also fell to 47.0 in December, signalling further contraction in the manufacturing and service sectors.

In the UK, inflation moderated more than expected with CPI falling to 3.9% in November. This contributed to hopes that the Bank of England may have finished with rate increases. The UK economy also contracted -0.1% in Q3 2023, down from prior estimates of a flat reading. Figures for Q2 were also revised lower to show no GDP growth instead of an initial estimate of a 0.2% expansion, highlighting the UK is nearing recession. The services sector fell -0.2%, business investment declined -3.2%, while government consumption was revised higher at 0.8%. Chancellor of the Exchequer Jeremy Hunt announced more policy measures to try and jumpstart growth. Including an extension of the 100% capital expenditure allowance, this allows companies to deduct expenditure on plants and machinery from taxable income.

In Japan, data showed the economy contracted -0.7% in Q3 of 2023, after 1.2% and 0.9% growth figures in the prior two quarters. The contraction came about through elevated cost pressures and mounting global headwinds, however the Bank of Japan tankan survey released in December highlighted ongoing improvement in business sentiment across manufacturing and non-manufacturing sectors. Capital expenditure plans also signalled strong demand in machinery and IT services. The BOJ made gradual steps to normalise its extraordinary monetary easing policy at the end of October and hinted that they are likely to take further action early in 2024.

In China, GDP growth for Q3 came in at 1.3%, beating expectations of 1% and accelerating significantly on the revised 0.5% growth figure for Q2. Q3 was the fifth consecutive period of quarterly growth, coming on the back of further monetary stimulus measures, including rate cuts and liquidity injections by China’s central bank. The property sector continues to be the biggest issue for the Chinese economy, as China’s biggest property developers stare down default. Age is also becoming a factor in China, with over 280 million people now aged 60 or older, but businesses that once targeted infants are now shifting their focus toward Chinese seniors, so there’s always opportunity in an economy!

In Emerging Markets, Brazilian inflation continued to moderate into the mid 5% range, which saw the central bank drop rates twice across the quarter, however figures showed the economy slowed to 0.1% growth in Q3. In South Africa there were fewer incidences of electricity load shedding across the quarter, but data showed GDP fell by -0.2% in Q3. In India the central bank continued to hold the policy rate at 6.5% as inflation moderated and GDP growth remained consistent, while the ruling Bharatiya Janata Party also saw strong results in key state elections. In Turkey inflation remained very high, over 60%, with the central bank increasing rates to 42.5% in December.

Back in Australia, data released in December showed GDP increasing by 0.2% for Q3 2023, with the economy growing by 2.1% over the financial year. GDP per capita, noted as a proxy for living standards, fell over the quarter again, down -0.5%. Inflation data was mixed but encouraging, with monthly CPI coming in at 5.6% for the year ending September 2023, up from 5.2% in August, but the October figure fell to 4.9% and November dropped to 4.3%. This was the lowest monthly figure since January 2022, with food, transportation (fuel prices), health, along with recreation all easing, with prices falling for household equipment and services. Clothing and footwear prices continued to fall.

There was one rate increase during Q4, as the RBA increased the cash rate from 4.1% to 4.35%, with the RBA noting “inflation in Australia has passed its peak but is still too high and is proving more persistent than expected”. The RBA target is 2-3%. The household savings rate fell to 1.1% in Q3 and is now at the lowest level since 2007. On its current trajectory the savings rate will soon be negative, something that hasn’t been seen since the mid 2000’s.

Housing prices continued to increase, with no capital/regional divergence during Q4. Both the combined capitals and combined regionals were each up 1.5%. Sydney was up 0.8% for the quarter and 11.1% annually, according to CoreLogic. Every capital registered a gain in Q4 except Melbourne, down -0.8%. The strongest markets for the quarter, were Perth at 5.1%, and Adelaide and Brisbane both at 3.7%. Hobart and Darwin were the only capitals to see a decline on an annual basis, down -0.8% and -0.1% respectively. Rents continued to push higher, with an increase of 9.8% across the combined capitals for 2023. Not surprising, as the government runs a record immigration program while monthly dwelling approvals sit 20% below the decade average.

Market Overview

Asset Class Returns

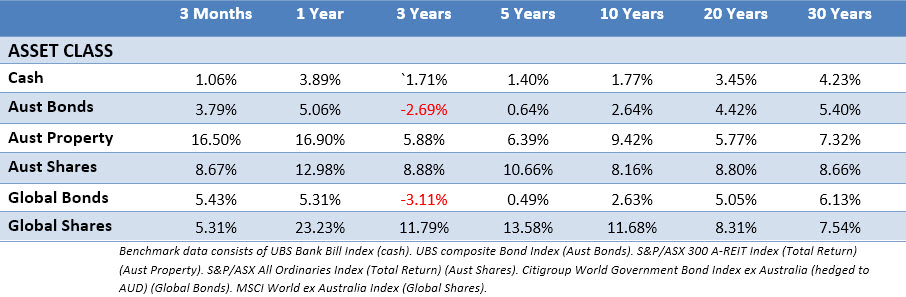

The following outlines the returns across the various asset classes to 31 December 2023.

Global sharemarkets delivered a strong returns in Q4 following a modest US inflation figure in November, the US Federal Reserve signalling interest rate cuts might be in the pipeline for 2024, and energy prices falling across the quarter. The Australian market was up 8.67% for the quarter, while Australian listed property really powered up with a double-digit return, though it should be noted it still sits well below its December 2021 peak. Bond prices increased in Q4 as yields fell, with the market turning its attention toward potential rate cuts in 2024. The 10-Year US Treasury yield fell for most of Q3, finishing at 3.86%. US 2-year yields also eased during Q3, with most of the movement in November and December, down from 5.05%, to finish at 4.25%. In the UK, the 10-year yield fell from 4.44% to 3.53%, dipping significantly in December. The Australian 10-year yield started the quarter at 4.5% and moved upward during October, before falling throughout November and December to end at 3.9%.

In the US, the S&P 500 was up 11.69% for the quarter, finishing up 26.29% for the year. It was once again “The Magnificent Seven” of Apple, Microsoft, Alphabet, Amazon, Tesla, Nvidia and Meta doing the heavy lifting, this seven contributed 15.5% of the S&P 500’s gain in 2023, while the other 493 stocks added 10.8%. it was excitement over the emerging field of artificial intelligence that helped propel some of the mega-caps, but profitability was also a factor. The Magnificent Seven are expected to post a 39.5% increase in aggregate earnings for 2023. The Russell 2000 small-cap index was up 14.03% in Q4, finishing up 16.93% for the year. Top performing sectors were those most sensitive to interest rates, including real estate, technology, and consumer discretionary. Financials and industrials also posted strong gains. The energy sector was slightly negative with crude oil prices weaker, while utilities were the worst performer.

In the Eurozone, there was strong performance in Q4 with the MSCI EMU index up 7.8%. In France the CAC 40 was up 5.72%, while the German DAX was up 8.87%. The strong performance came from expectations that further interest rate rises were unlikely. Most sectors rose amid optimism over future rate cuts. The real estate sector advanced strongly due to the potential for cheaper debt. Technology companies also performed well, while economically sensitive sectors such as industrials and materials delivered strong gains. By contrast, healthcare and energy were the two main laggards, with negative returns.

In the UK, equities rose over the quarter, but large caps were more muted than in other markets as larger companies struggled with the pound’s outperformance against a weaker US dollar. The large companies that did best were in economically sensitive areas of the market such as the industrial and financial sectors. The FTSE 100 only managed a 1.64% gain for Q4, while the mid cap FTSE 250 was up 7.71% and small caps were up 5.38%. Like elsewhere, the performance was mostly underpinned by increasing hopes interest rates may have peaked, while there was also a higher interest in smaller UK companies from overseas investors.

In Japan, large companies saw the best performance across Q4, with a 5.04% gain for the Nikkei 225 index. In contrast, the broader TOPIX Total Return index only notched a 2.0% gain for Q4. Most of the gains were seen in November as October and December were flat to weak. In October, worries that US interest rates may remain higher for longer weighed on the market, while geopolitical risks, such as conflict in the Middle East, caused some concern. However, investor sentiment improved, due to weaker-than-expected macroeconomic figures in the US and the expectation of rate cuts. While the US market continued to rise in December, the Japanese equity market lagged as investors became concerned about yen appreciation. From a corporate fundamentals standpoint, things remained strong, with the first half of the fiscal year concluding with quite strong earnings results.

Asia (ex-Japan) and Emerging markets were strong in Q4 2023, albeit lagging developed market equities. The “soft landing” narrative for the US economy and potential for rate cuts in 2024 were supportive. However, China’s outsized influence continued to be a drag on broad emerging market performance. Poland was the top performer as markets welcomed Donald Tusk’s election as prime minister at the head of a pro-EU liberal coalition government, ending the eight-year rule of the Law & Justice party. Peru, Egypt and Mexico also posted strong returns. Brazil’s outperformance was helped by moderating inflation and rates cuts, while Taiwan and Korea saw strong performance due to their technology sectors. Negative returns were seen in Kuwait, UAE, China, and Turkey, which was one of the worst performers as raging inflation took its toll.

The Australian market (All Ords Accumulation) was up 8.67% in Q4 rounding out a 12.98% return for 2023. October was mostly flat before the tailwind of moderating inflation and the US rate cut narrative took ASX on a two-month rally. This also coincided with gains in the iron ore price throughout November and December due to Chinese stimulus, which saw the big miners get a lift. The big winner in Q4 was listed real estate, up 16.5% as the sector salivated at the prospect of rate cuts. Health care saw strong gains as CSL rallied after months in the doldrums. Materials were up 13.17% off the back of the iron ore price rise. Financials slightly lagged the index, with consumer staples flat. The only two sectors in the red for Q4 were utilities and energy, which saw a -8.97% loss as the oil price spent the quarter falling. ASX small ordinaries were up 8.52% for the quarter, but only up 7.82% for the year.

Vale Barry LaValley

We were saddened to learn of the passing of Canadian retirement expert Barry LaValley in December. Barry was one of the most polished speakers and engaging communicators we’ve encountered. This was reflected by his regular speaking tours across Canada, New Zealand, Australia, and the UK and US, where he’d be consistently booked by financial advisers and investment managers to speak to their clients about retirement matters.

A friend of our our dealer group, FYG Planners, Barry visited Australia on multiple occasions, speaking at FYG Planners conferences several times over the years. Barry will be missed.

Barry’s obituary via Ever Loved

LaValley, Barry Jay (May 22, 1953 – December 13, 2023) died peacefully comforted by his wife Melissa and son, Peter. Diagnosed 15 years ago, Barry lived with his cancer in the same way he lived his life, with curiosity, enquiry and with positive belief he would not let the disease overtake his love of life. He would live on his own terms.

A Calgarian predeceased by this parents, Pete and Gerry, and older brother Peter, Barry is survived by brothers, Gary, Greg, Tim and sister Darlene, innumerable colleagues, friends and the two most important people of his life, beloved wife Melissa and son, Peter.

Barry chose work, career and personal endeavours in the way he saw life, “do and say the right thing”. Mostly indifferent to criticism, he pursued his sports passions as a referee in amateur, major junior and professional hockey. After attending the University of Calgary, he established a career in the investment industry achieving success at a number of national and international firms.

Barry’s foresight as an investment leader and educator led him to become a sought after consultant and speaker to thousands of future retirees, helping secure their financial future. Barry travelled throughout North America, Australia, and Europe, consulting with major organizations, sharing his retirement planning knowledge and ideas. Barry was an early visitor to the growing financial industry in Mainland China.

Ever curiously and aware of the world, Barry found ways to seize the moments in life. From the dressing room of the Edmonton Oiler Stanley Cup winning team, the final round of the PGA Open, climbing the Sydney Harbour bridge with son, Peter, to visiting the Great Wall, Barry found countless adventures because the world was out there and was to be enjoyed.

His sports passion did not end with hockey. A life long golfer, Barry’s happiest times were on the golf course, particularly the Nanaimo Golf Club, with fellow golfers and friends. Nothing gave Barry more joy than spending the day partnered with his true love, Melissa.

Together Barry and Melissa shared their life together fully, proud of their son Peter and surrounded by friends and family.

Barry leaves us, better for having him in our lives while holding on to the memory of a life lived positively with his never-ending smile.

A Celebration of Life took place on Barry’s 70th birthday.

This article is for informational purposes only and the information contained is of a general nature and may not be relevant to your particular circumstances. The circumstances of each investor are different, and you should seek advice from a professional financial adviser who can consider if particular strategies and products are right for you. In all instances where information is based on historical performance, it is important to understand this is not a reliable indicator of future performance. You should not rely on any material on this website to make investment decisions and should seek professional advice.