The NSW Government announced on 26 July 2020 that they will reduce stamp duties on newly built homes and vacant land for eligible first home buyers from 1 August 2020.

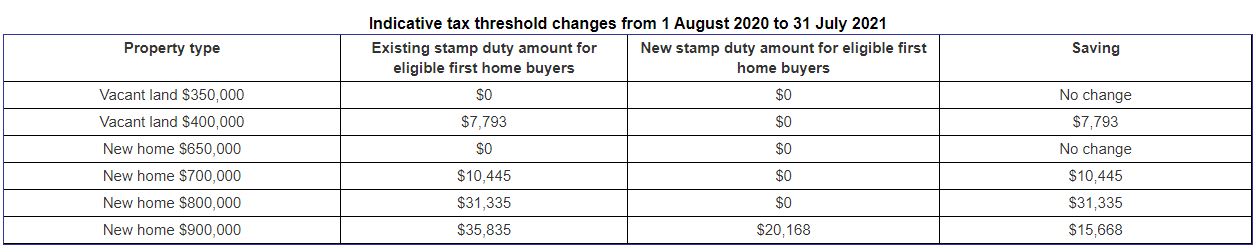

The threshold above which stamp duty will be charged on new homes for eligible first home buyers will increase from $650,000 to $800,000, and concession on higher values will be reduced before phasing out at $1 million. The stamp duty threshold on vacant land will rise from $350,000 to $400,000 and will phase out at $500,000.

The changes are part of the NSW Government’s COVID-19 recovery plan and will apply to contracts executed from 1 August 2020 to 31 July 2021. The changes will be available to first home buyers who purchase a new home or a vacant block of land on which they intend to build a new home. The changes will not apply to existing homes.

Source: CCH IntelliConnect

How can a financial planner help you?

Your home might be the biggest purchase you’ll ever make and when considering buying you will be faced with an array of important decisions. Call 02 6813 0977 today to assist you.