Economic Overview

2020 will be a year of note in the history books. The problems started pre Q1 when spring 2019 bushfires seemed to rage endlessly in parts of Australia, extending into Q1 and contributing to one of the country’s worst bushfire seasons on record. Hot on the heels of the bushfires, the COVID-19 pandemic spread globally, becoming the largest global health crisis since the Spanish flu a century earlier. The international policy response was initially staggered and confused, but much of the world put in place some form of containment, social distancing, or economic pause in an attempt to flatten the virus curve. The results were varied, and the economic impact was significant. Finally, there was widespread civil unrest in the US tied to policing and racial justice.

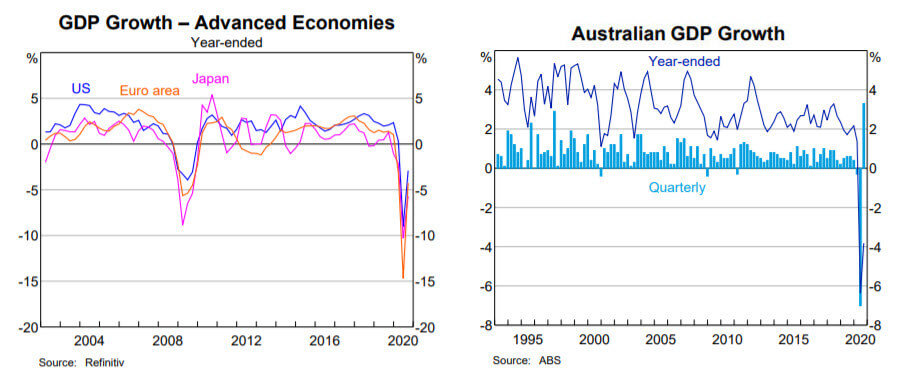

Across the US, companies and schools closed with millions of Americans working and studying from home. Many smaller businesses closed permanently, and the US unemployment rate shot from 3.5% to 14.7% in two months’ time. Weekly unemployment claims spiked from 282,000 to 6.9M in two weeks. In Q2, U.S. GDP saw the largest annualized decline on record of -31.4%. Beginning March, the US Federal Reserve pulled its ‘financial crisis’ playbook. It reinstated a zero interest rate policy, quantitative easing and established U.S. dollar swap lines to central banks around the world.

Source: RBA 2021

The Federal Reserve announced it was ‘committed to use its full range of tools to support the U.S. economy in this challenging time and thereby promote its maximum employment and price stability goals.’ This ongoing support coincided with large fiscal stimulus via the $2.3 trillion Cares Act, which provided direct stimulus to individuals.

After recovering from its low, the US economy then weakened toward the end of 2020. Personal income and consumer spending declined in November, with some measures of housing activity also weakening as the virus continued to spread. Although the number of new infections began to slow toward the end of December, there are worries holiday travel will result in another surge in infections. Positively, vaccine distribution has begun, but is far behind initial plans.

The other significant matter of note was the US Presidential election. President Trump’s transition to President elect Joe Biden has been anything but smooth, but once inaugurated President elect Biden is expected to ask Congress for further funding to aid economic recovery, increase virus testing, while also boosting vaccine distribution.

In the European Union, virus cases spiked toward the end of Q4 before flattening as economic restrictions were implemented and mobility was reduced. Many governments across the EU extended labour market support well into 2021 to avert further economic distress. The result is likely to be a strong upturn in growth in the first quarter of 2021 after a likely decline in activity in the last quarter of 2020. Toward the end of 2020 vaccine distribution was under way. However, as with the US, distribution is slower than planned. The European Central Bank is unlikely to end support to the market for government debt, especially as long as inflation remains muted.

Notably, after losing the UK, the EU signed a new investment agreement with China after seven years of negotiation. The EU claims that the new agreement creates a level playing field for EU companies and ends forced technology transfers. In addition, the EU says that the deal eliminates the requirement that European companies have a local partner in China. The incoming Biden administration advised against the deal, wanting the US and EU to take a common stance on China.

As noted, the UK finally separated from the EU in December, in an eleventh-hour deal after nine months of tortuous and fractious negotiations. The deal allows trade in goods between the United Kingdom and the EU to take place without tariffs or quotas. However, trade will now involve bureaucracy and border controls, adding costs and reducing speed. The passage of a deal is a relief to many who worried a no-deal Brexit would have been catastrophic. Still, the British government’s own Office of Budget Responsibility (OBR) says the current deal will reduce real GDP by 4% versus if the UK had stayed in the EU. Unfortunately, the latest spread of COVID-19 was significantly disrupting trade towards the end of December. Data released in the middle of December was upbeat, with manufacturing was rising, possibly pumped by some pre-Brexit stockpiling. Services, the UK’s biggest sector, also managed to rebound slightly, despite the tighter restrictions after England’s second lockdown in November. Covid cases rose to 55,892 on New Year’s Eve, the highest since mass testing began in May. Thankfully both the Oxford University and AstraZeneca vaccine along with the Pfizer and BioNTech vaccines were rolling out by year end.

In Japan, data released for the third quarter showed a recovery in GDP, up by 5.3 percent compared to Q2 which featured the sharpest decline in the last quarter since the start of the GDP recording of the country in 1955. Japanese economic activity looked to be weakening towards the end of 2020 as COVD-19 cases increased.

In China, economic growth continued its recovered at a healthy pace with a 4.9% advancement based on Q3 data. Consumer spending was also boosted by confidence COVID is under control. Exports have performed well, in part owing to China’s global competitiveness in technologies for which demand has accelerated during the pandemic. This includes personal protective equipment (PPE) and technologies used for remote interaction.

Emerging market economies experienced a range of economic outcomes during the pandemic, but like many other countries, the common denominator was a temporary collapse in economic activity followed by a rise in debt. Although many emerging countries are now growing rapidly, the ability to fully recover from this situation will depend on many factors, not the least of which will be the speed at which vaccines are distributed in poorer countries.

Back in Australia, data showed the Australian economy had emerged from its first recession since the 1990’s with 3.3% GDP growth. Acknowledging the figures, the RBA Governor Philip Lowe said, “These positive figures, though, cannot hide the reality that the recovery will be uneven and it will be bumpy and it will be drawn out. Some parts of the economy are doing quite well, but others are in considerable difficulty.”

The major economic issue during the quarter was Australia’s ongoing trade dispute with China. China slapped tariffs on Australian wine and barley, while placing restrictions on coal, lobster, timber, red meat and cotton. Notably, iron ore was excluded. Finally, the perceived flight from cities was also a factor in Australian real estate, with CoreLogic data showing regional real estate prices outperforming the capital cities for the first time in 15 years. The suggestion was many took the opportunity to work from home or buy a second property in anticipation of a move.

Market Overview

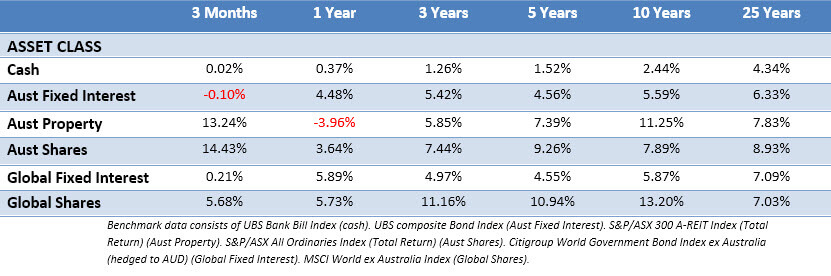

Asset Class Returns

The following outlines the returns across the various asset classes to 31st December 2020.

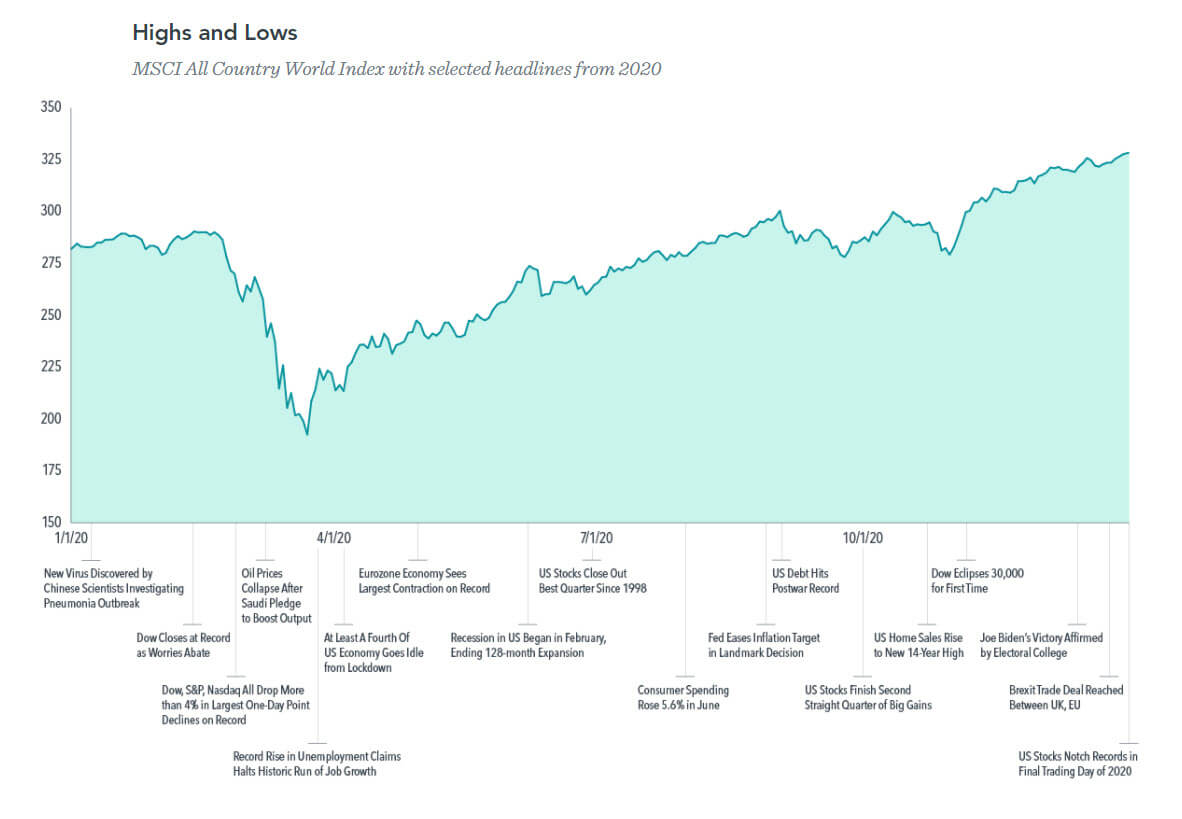

Sharemarkets around the world offered positive returns in Q4 to ensure the year finished with modest gains, a position unthinkable to many after the rout of late February to mid-March.

US shares gained in Q4, with a strong November due to the vaccine developments. In addition to the vaccine news, Joe Biden’s win in the US presidential election, along with $900 billion stimulus package announced in late December proved to be positive developments. The Federal Reserve reinforced its supportive message, stating the current levels of quantitative easing will continue.

European shares gained sharply in Q4, again on the news of effective vaccines. Sectors that had previously suffered most severely through the pandemic, such as energy and financials, were the best performers. UK shares also performed well over the quarter reversing some of the underperformance suffered against other regions during early stages of the pandemic. The market responded well to November’s vaccine news and then again to the Brexit trade deal, with domestically-focused areas of the market outperforming.

Japanese share rallied in the quarter, driven from early November by vaccine-related news and the US presidential election result. Asia outside Japan also rallied strongly. South Korea was the best-performing index market, aided by strong gains from the tech sector. Indonesia, Taiwan, the Philippines and India finished ahead of the index.

Emerging market shares generated their strongest quarterly return in over a decade, with US dollar weakness amplifying gains. The rally in commodity prices was supportive of net exporters. China finished in positive territory, but lagged with the launch of an anti-trust investigation into Alibaba and further escalation in US-China tensions dragging on sentiment.

The Australian market posted a double digit return in Q4 with a strong performance from financials, energy, information technology and materials, with the big miners such as BHP, Rio Tinto and Fortescue posting strong gains off the back of a soaring iron ore price. In contrast, utilities continued to struggle.

2020 Lessons: Universal Truths

Uncertainty remains about the pandemic and the broad impact of the new vaccines, continued lockdowns, and social distancing. But the events of 2020 provided investors with many lessons, affirming that following a disciplined and broadly diversified investment approach is a reliable way to pursue long-term investment goals.

Market Prices Quickly Reflect New Information about the Future

The fluctuating markets in the spring and summer were also a lesson in how markets incorporate new information and changes in expectations. From its peak on February 19, 2020, the S&P 500 Index fell 33.79% in less than five weeks as the news headlines suggested more extreme outcomes from the pandemic. But the recovery would be swift as well. Market participants were watching for news that would provide insights into the pandemic and the economy, such as daily infection and mortality rates, effective therapeutic treatments, and the potential for vaccine development. As more information became available, the S&P 500 Index jumped 17.57% from its March 23 low in just three trading sessions, one of the fastest snapbacks on record. This period highlighted the vital role of data in setting market expectations and underscored how quickly prices adjust to new information.

One major theme of the year was the perceived disconnect between markets and the economy. How could the equity markets recover and reach new highs when the economic news remained so bleak? The market’s behaviour suggests investors were looking past the short-term impact of the pandemic to assess the expected rebound of business activity and an eventual return to more-normal conditions. Seen through that lens, the rebound in share prices reflected a market that is always looking ahead, incorporating both current news and expectations of the future into stock prices.

Owning the Winners and Losers

The 2020 economy and market also underscored the importance of staying broadly diversified across companies and industries. The downturn in stocks impacted some segments of the market more than others in ways that were consistent with the impact of the COVID-19 pandemic on certain types of businesses or industries. For example, airline, hospitality, and retail industries tended to suffer disproportionately with people around the world staying at home, whereas companies in communications, online shopping, and technology emerged as relative winners during the crisis. However, predicting at the beginning of 2020 exactly how this might play out would likely have proved challenging.

In the end, the economic turmoil inflicted great hardship on some firms while creating economic and social conditions that provided growth opportunities for other companies. In any market, there will be winners and losers—and investors have historically been well served by owning a broad range of companies rather than trying to pick winners and losers.

Sticking with Your Plan

Many news reports emphasized the unprecedented nature of the health crisis, the emergency financial actions, and other extraordinary events during 2020. The year saw many “firsts”—and subsequent years will doubtless usher in many more. Yet 2020’s outcomes remind us that a consistent investment approach is a reliable path regardless of the market events we encounter. Investors who made moves by reacting to the moment may have missed opportunities. In March, many panicked investors liquidated holdings. Then, over the six-month period from April 1 to September 30, global shares returned 29.54% and Australian shares 17.59%. A move to cash in March proved to be a costly decision for anxious investors.