In one corner there are the private economists who might be pushing the subject of their books. In the other corner there are the industry and bank economists who might be protecting their employers’ interests.

What are we talking about? The great Australian real estate bubble debate. It kicked off again this week when the media reported on the submission by economists Lindsay David and Phillip Soos to the Federal Government’s home ownership inquiry. The pair claimed housing prices across all capital cities remain grossly inflated relative to rents, income, inflation and GDP.”

They were particularly concerned about Melbourne because according to their analysis of Bureau of Stats data, there’s a significant oversupply of apartments – 123,242 of them to be exact.

It prompted a reaction from economists in the banking and real estate industries – suggesting that David and Soos’ submission was “overdone” and “hysterical”.

The rebukes came from Hans Kunnen of St George, Andrew Wilson of Domain and Shane Oliver of AMP, who said he’d “heard it all before.”

“There have been imminent crashes coming since 2003. “Despite warnings of a crash around the corner – or a bloodbath – it hasn’t happened and it probably won’t.”

Interestingly, one of the places Oliver had likely heard it before was from himself. Back in November 2008 he published a report under his well-known “Oliver’s Insights” banner for AMP, arguing that “Australian housing remains highly overvalued, by an average of 23%.”

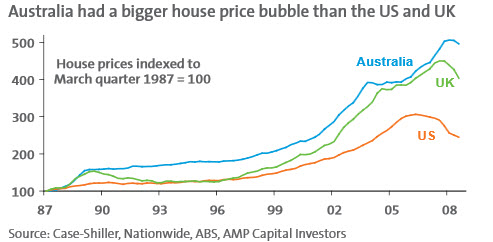

He even used the word “bubble” when comparing Australian real estate to the US and UK at the time, and suggested “house prices need to fall a long way to improve housing affordability.”

In 2008 Oliver noted the following about Australian real estate:

- The boom in Australian house prices has gone hand in hand with surging household debt;

- Household debt as a percentage of household income had surged to be near the top against other developed countries;

- Rental yields were low.

In the subsequent six and a half years, some things about Australian real estate have changed (along with Oliver’s opinion).

- Mortgage debt is now at record highs measured against incomes and Gross Domestic Product;

- House prices are at record highs and continue to outpace incomes;

- Rental price growth is at all-time lows.

Several things Oliver was concerned about in 2008 have worsened, yet he’s now no longer concerned.

In respect to Oliver’s employer AMP, some things have changed for their business since 2008. In 2012 AMP first offered loans to buy residential property within self-managed super and in 2013 AMP launched a specialised self-managed super business arm which offers platforms to manage residential property within the SMSFs.

Now we’re not suggesting AMP’s business aims have affected Oliver’s analysis, but economists can become mindful of not saying the wrong thing. Evidence of this comes from the comments of former US Federal Reserve Chairman Ben Bernanke in 2004 when he was a Federal Reserve Governor. A time when house prices in the US were shooting into the sky and there were dire warnings about the market overheating.

In an interest rates committee transcript, Bernanke offered the following when the discussion turned to what to tell the US public about raging house prices, “one’s inclination is to answer by painting a benign picture so as not to cause unnecessary public concern.”

Which isn’t very reassuring if you’re looking for an accurate economic picture. It seems if you want a straight and unvarnished answer from an economist you’ll need to wait until they no longer hold any position of authority or influence, lest they believe their words scare the public, or conflict with the interests of their employer.

Suggesting that most economists are almost useless when doing their job of offering economic or financial guidance!

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation and individual needs.