When it comes to the share market the media has a notoriously short term focus. And because few investors compile their own stats on share market returns, the media ultimately becomes our share market news filter.

Each day they tell us what the market has done for that day. Not the last rolling 30 days or the last rolling quarter, rolling half year, year, 3 years etc. Of course that would be an extremely time consuming and possibly cock-eyed way to report, but when you consider the fact that it would be rare for someone to invest for a solitary day in a market index, you could argue reporting on that day’s market movement is an equally cock-eyed way of reporting.

Sadly the media still control the airwaves, so they continue to dictate the terms. So we’re left with the cycle of “today was positive/negative” and that leaves us forever focused on (and often fretting) about the short term when our horizon is multi-year or decades.

You can keep reminding yourself of those longer timelines though and the probabilities of positive returns over those longer timelines.

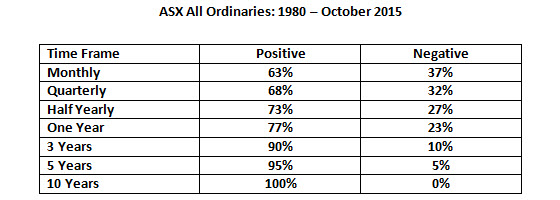

The following chart is a compilation of historical returns for varying time frames since 1980 on the ASX. As you can see as time frames grow so do their positive returns. This is no indication of the future, so again we should always think in terms of probabilities, but the data does suggest the longer your horizon, the higher probability of seeing a positive return in the share market.

The data is calculated with rolling periods, so it captures every possible monthly, quarterly, annual etc return from the beginning of 1980 until October 2015.

Questions

Does this mean that you’re guaranteed to earn a certain level of returns in stocks if you hold them for a specified time frame? No.

Will these same results be guaranteed to repeat themselves in the future? No.

Has anyone figured out a better way of compounding your money in stocks beyond increasing your holding period? Not many.

A couple of interesting points:

The total return between 1980 and October 2015 using monthly rolling returns was 4434% – which shows the beauty of compounding returns.

The best average annualised 10 year return during that period was 18.37% and the worst was 5.37%.

The usual caveats apply here — these numbers are before inflation, taxes or costs are taken into account (although one of the biggest benefits about a longer holding period is that you can reduce the impact of trading costs and taxes on your portfolio).

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation and individual needs.