“Why do you include so many bad news stories?” It’s a question we’ve been asked, not regularly, but maybe it needs addressing.

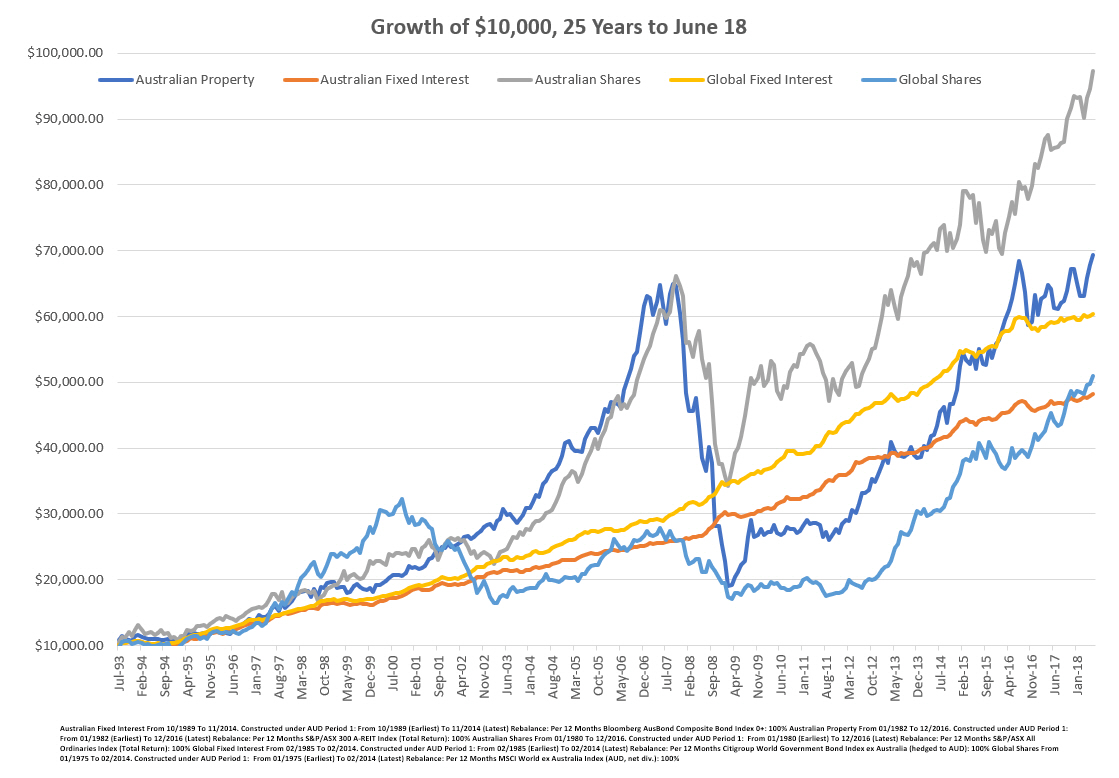

First off here’s a good news story. This is the growth of $10,000 over the past 25 years in five different asset classes. If you’ve been invested inside and outside of superannuation, you’ve had a decent bite of that. Even better news, all you had to do was open your mouth and the market spooned the returns right in. What’s better than that?

That’s 25 years and despite the fact everyone should think in those timeframes, very few think in those timeframes. There are a lot of frightening dips there, so what if you’d bought at the top before the last major dip?

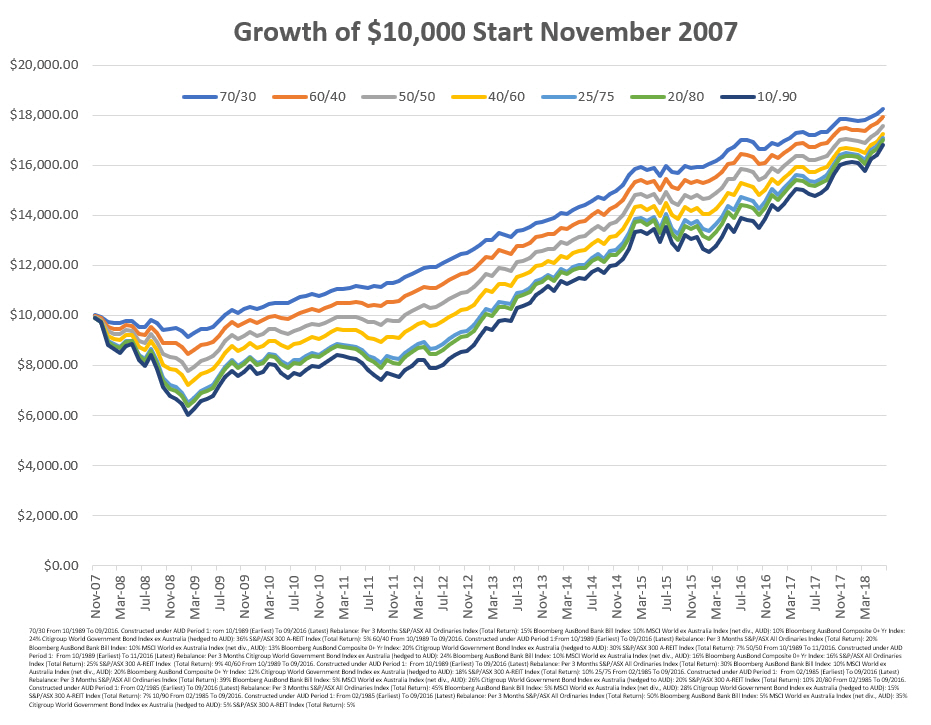

About the worst time you could have bought into the market in recent memory was November 2007. There was a significant amount of volatility in 2007, but no one knew equities were about to take 40%+ whack over the next 15 months. Depending on your asset allocation those 15 months would have ranged from mildly annoying to severely testing (there are more profane descriptions) but there was a reward for staying the course. The uniform pattern of portfolio returns above shows this much. The chart shown ranges from a more defensive 70/30 (majority fixed interest & cash) portfolio to a very aggressive 10/90 (majority equities) portfolio.

When you’re dealing with capital markets, time is the salve when they get ugly. If you believe capitalism will continue to work, eventually returns will reappear. If you don’t believe capitalism will continue to work, there’s no investment that will perform in that scenario, so stock up on canned food. Just don’t bank on electricity to cook anything, but that’s another conversation.

If your portfolio is aggressive, the historical data says the growth will be greater, but so will the falls when they come. More conservative? You’ll be sacrificing growth, but you’ll be spared the deeper valley along with the extended journey back to your previous highs.

These are the known knowns of combining diversified equities, fixed interest, listed real estate and cash together. The returns are never certain, but certain patterns emerge over the longer term.

What’s not known is what happens when an investor steps off this path. Maybe they’re taken in by an untested speculation, tax avoidance lurk, a lifestyle investment or some guy promising a system. While not as scientific or rigorously definitive as the data crunching that we’ve based our portfolios on, when we come across one of these alternatives another pattern emerges – it usually ends badly.

The reason we also highlight these bad news stories is because investors are still taken in by them.

We’ve been doing this for a while now. We have colleagues that have been doing this for a while now. It’s all the same. It’s a collective knowledge base that comes to the same conclusion. It’s not the markets that cause people the biggest headaches. It’s how they react to the markets and it’s the unproven returns they chase.

The people who know this the best are the shonks and scam artists who know they can dupe and manipulate the financially naïve. We highlight the bad stories because as professionals we’re morally offended at some of the nonsense and lies where investors are promised great returns and more opportunity to make decisions and have control, while being scared away from, or out of capital markets. Unfortunately, the shonks are sometimes aided and abetted by media who legitimise them.

The cost is the capital blown, the opportunity cost of gains missed and the emotional turmoil of the mistake and loss.

Bringing us to ASIC’s recent report on SMSFs. Interviews with SMSF members revealed a terribly uneducated number of investors who didn’t understand what they were getting into. Ripe for exploitation. The key issues for us? People using SMSFs ‘solely’ for the purpose of getting into the property market, without a wider investment strategy and the number of ‘advisers’ who had a relationship with developers or real-estate agents and push their properties.

The old one stop where the adviser, mortgage broker, accountant and developer are magically linked just to make it more convenient for the client. Essentially a bunch of sales crooks loading up an off the plan investment property with fees to flog to some poor sod who might feel they have more financial control because they’ve got property in an SMSF.

As some of those interviewed by ASIC admitted why they wanted an SMSF:

“You’ve got more control with [an] SMSF because it’s yours. You’re the boss.”

“Here I am, my hands are tied in chains and I am just looking at it. This is what I think the super is at the moment … This is a big safe and there is my hard earned money hundreds of thousands of dollars sitting there, and there is a big lock on it.”

“I guess it’s that I’m actively deciding on what my money is going to do probably the most influencing for me.”

Remember those spoon-fed gains at the start? The good news is they’re always available by doing nothing. The bad news is the average investor will always be their own worst enemy because they don’t want to do nothing.

A reason to keep reminding everyone about those bad news stories. The ones where investors are determined to do something, when doing nothing would have been more appropriate.

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation and individual needs.