If you’re interested in financial matters, some of the most interesting and entertaining content on the internet can be found at Dave Ramsey’s YouTube channel.

From the US, Dave is a southern gentleman who once went bankrupt. From there, he turned his life around and cleaned up his financial act. He started by publishing a book on his experiences, then built a publishing and media empire based on the principles he used to fix up his finances his life.

What makes Dave Ramsey’s videos so interesting are his interactions with real people. All walks of life call in with questions and concerns about money, debt and investing. Watch one Dave Ramsey video and before you know it you’ve watched ten.

The reason they’re so addictive? The picture below is a common Dave Ramsey reaction to callers. Many are strange and outrageous, but all underline money is foremost a behavioural issue. The other entertaining part is the guy taking the calls. Dave can be quite blunt and has some forthright views.

One of Dave’s views is investment costs don’t matter. He claims it’s returns and savings that make the difference. Dave will go on quite passionate rants about his critics such as financial advisers and the ‘investment nerds’, who argue very factually that investment costs do matter.

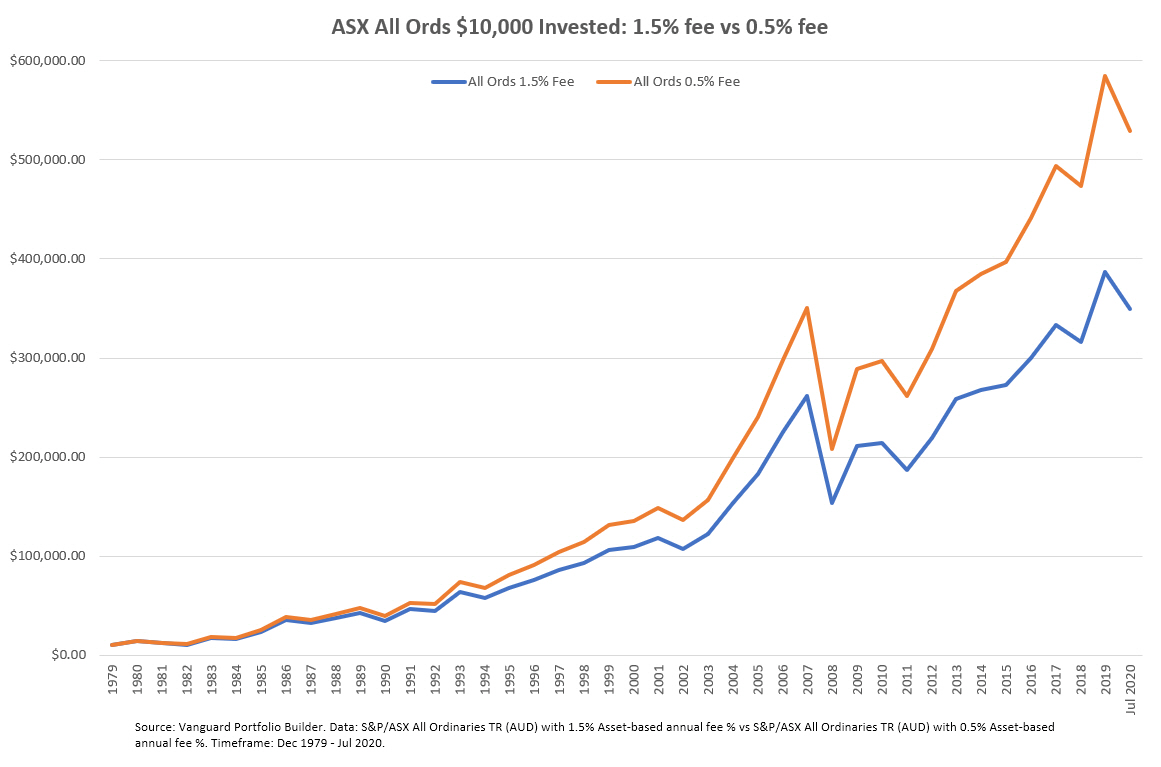

There’s no question, fees are a drag on returns. Take the ASX All Ords Accumulation Index over the past forty odd years. A 1.5% asset fee vs a 0.5% asset fee over that time frame on $10,000 initially invested makes an enormous difference. Almost $200,000 over that time frame. So, it’s simple maths. Fees matter. If you want to use a health or fitness analogy, fees are like a bad diet, you can’t outrun them.

Dave uses processes that primarily focus on behaviour. They align with some simple and important ideas. Get out of debt. Save money. Invest money. The tweaks such as worrying about fees are distractions. As long as that money goes into stock funds, you’re doing better than you would have been doing otherwise. That is true, but tweaks certainly do matter, otherwise an investor might be working harder than they need to be.

In one of Dave’s passionate rants, he referenced a report from ASPPA’s Quarterly Journal for Actuaries, Consultants, Administrators and Other Retirement Plan Professionals, titled ‘Retirement Success: A Surprising Look into the Factors that Drive Positive Outcomes’. The surprising news from the study, wasn’t so surprising, but maybe sometimes overlooked. The authors found the most important factor in retirement success was saving money. More important than asset allocation, asset quality, or actuarial guidance.

It is understood that asset allocation is the most significant factor in determining returns. And it is – as long as you have money. If you do not save, you will not have savings. If you do not save enough, you will not have enough savings.

Saving is incredibly important, but how powerful is saving vs the power of markets?

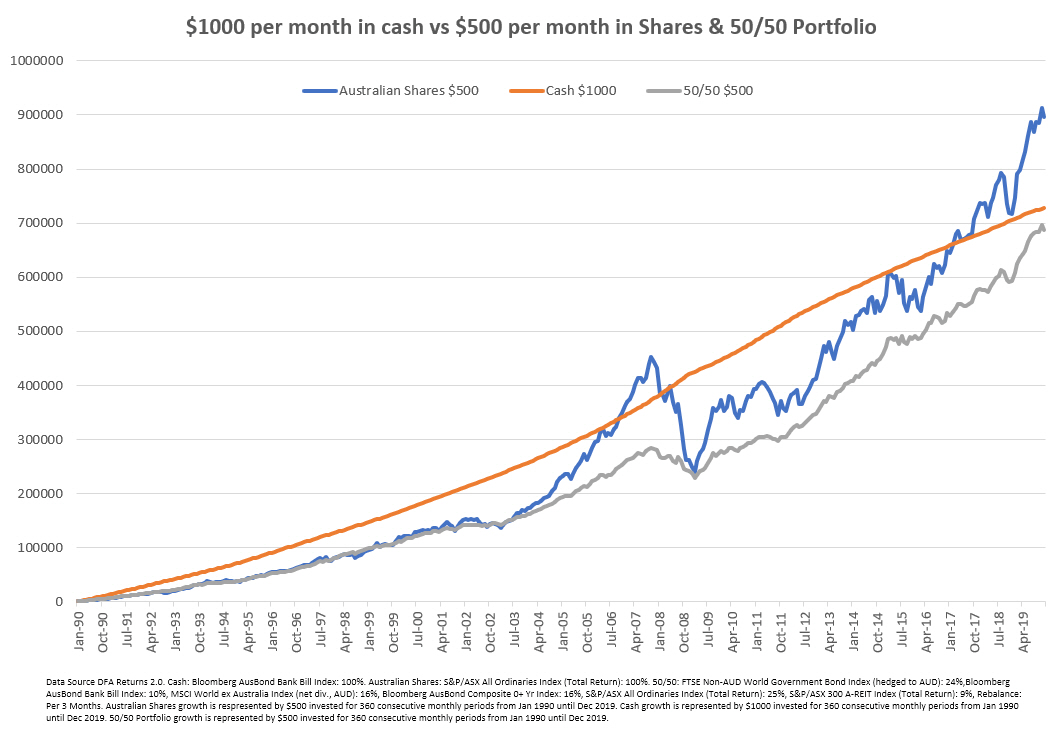

Between 1990 and 2019, a thirty-year period, had an investor saved $1000 a month and left it to compound at the cash rate, they’d have $728,254. It’s an impressive result and it would be quite the disciplined effort. Cash returns have run the gambit. Early days interest rates would have been very high, around 16%, lately they’re around 1%. For the most part though, the hard work was done by the saving.

To highlight the power of markets, we’ll cut that $1000 in half. Same time period, but investing $500 a month into Australian shares instead. The end result is $895,324. Half as much money invested in the Australian sharemarket outpaced the doubled savings rate! While $500 invested in a 50% growth, 50% defensive portfolio just trails the doubled savings rate, with an end result of $686,891.

What this does show, is if an investor can save significantly more, they can potentially dial down the risk they need to take to achieve their goals. But the power of saving has to be very strong to overcome the power of markets. However, this is timeframe specific and would need a more thorough analysis taking into account many more simulations.

That’s saving towards a goal, what about drawing down through retirement?

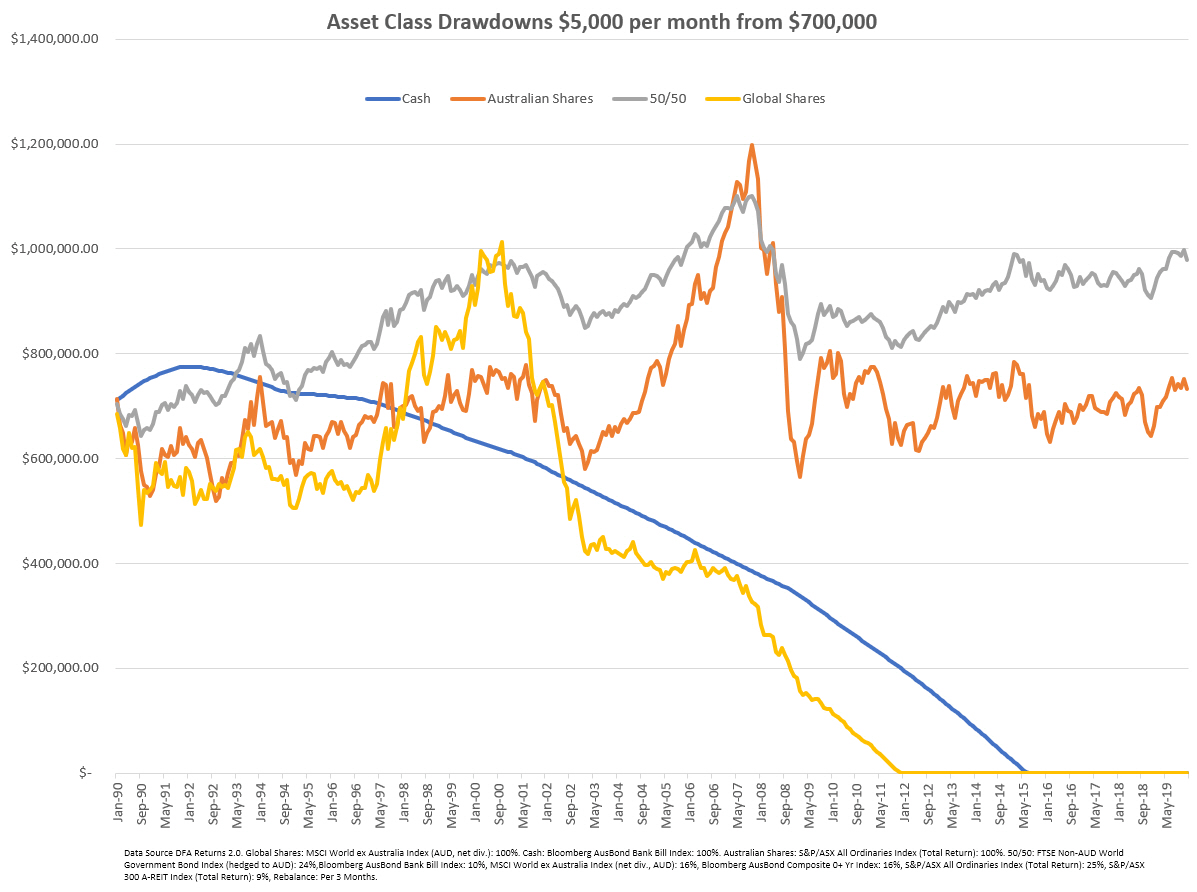

Again, this is looking from 1990 to 2019. We’ll start with $700,000 because the previous results ended up near that sum. Again, we’ll use cash, Australian shares and the 50/50 portfolio, but we’ll also add in Global Shares for interest. Every month $5,000 will be drawn from the portfolio.

This exercise shows how important asset allocation can be.

If you define success as meeting your spending goals while not running out of capital, this would have been successful using Australian shares and the 50/50 portfolio. Cash was exhausted four and a half years early. Global shares were exhausted eight years early. There is some irony here, and it shows how important the sequence of returns can be. Global shares had a powerful past decade, but the terrible returns in the decade prior to that ensured the portfolio would hit zero before they arrived. If you don’t have any capital, you don’t get to participate. The money drawn as a percentage of the portfolio overwhelmed the returns of the recovery in 2009. After that, it was in terminal decline.

Similarly, as cash returns plummeted, the cash portfolio turned terminal. Retiring on cash is like saving for a long-term goal with cash. It takes a lot more effort. An investor needs to either start with a whole lot more or spend a whole lot less.

While Australian shares basically held their ground, the star of the show was the 50/50 diversified portfolio. Not only did it shoot out $5,000 a month, its value increased from $700,000 to $979,207. It had a lower return than the Australian shares, but its diversification meant lower volatility and ensured it suffered less in the downturns. This meant money was drawn at higher portfolio values and it was able to compound more easily when growth returned.

Saving is incredibly important. It’s always the first step, but an investment strategy requires much more nuance than a financial media personality can provide. Fees definitely matter and so does the construction of your portfolio. If an investor can save and invest, they shouldn’t just stop there. There are always other ways to add value and ensure their money can work smarter.