Risk-free is a single, predictable outcome. Risk is the opposite, all the things that might happen and the odds that they will.

So begins chapter four of Alison Schrager’s book ‘An Economist Walks into a Brothel’. In the book Schrager finds herself in all manner of situations and environments, including the aforementioned brothel. Her goal? To examine how various people and institutions measure risk and then increase or reduce it according to their preference.

In that brothel, Schrager, an economist and retirement consultant, found how risk was being priced for the parties on either side of the transaction. The ‘service providers’ pay a huge cut of their earnings to operate in a legal environment, protecting their safety. No homicidal maniacs or police busts. The ‘clients’ pay a much higher price for visiting a legal environment they can trust. No potential blackmail or police. For the service providers it’s a 50% cut to the brothel. For the clients it’s a 300% mark-up on the price paid for an illegal service.

Why did Schrager use the example of the brothel to explain risk? Whatever our thoughts on the transaction, both parties are behaving incredibly rationally with their attitude to risk. Together they acknowledge the risks involved in the industry. They price it accordingly and essentially do their best to eliminate it for the price paid.

Risk sits at the forefront of every investor’s thinking right now. Unlike the above scenario, investors don’t have the luxury of completely eliminating risk. They must take steps to prudently manage it so there are no rude surprises.

A good adviser will use an investment strategy as their rulebook. Some key principles would be: A belief in markets; Understanding the risk/return characteristics of assets; Diversification; How portfolio construction determines returns; Maintaining discipline; Smart portfolio rebalancing; Cashflow management attuned to the investor; Selection of quality asset managers; Choice of reliable custodian; Low asset and custodian fees; No compensation from asset managers.

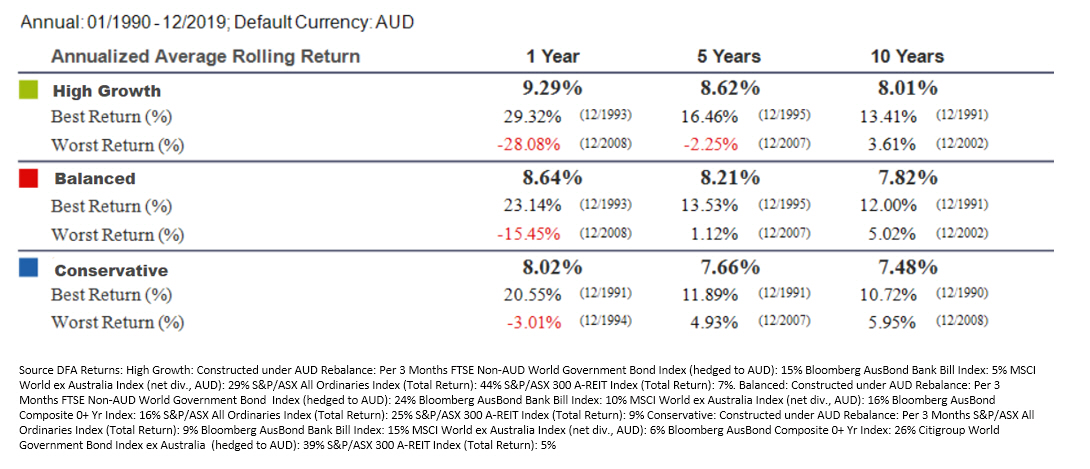

On an individual level, an investor will be furnished with documents that highlight the historical performance of their portfolio. There are no illusions. Short term, the prospect of portfolio decline (or gain) is clear. Long term the variance narrows. Three different portfolios and their returns behaviour are shown below. The variance is clear along with the risk/return characteristics.

None of the principles eliminate risk, but the data behind each forms an evidence-based process where risk is understood, and rude surprises are minimised. They help control the process to the greatest possible extent. The one uncontrollable is the market. Current market movements aren’t welcome, but there is an expectation they occur. Planning occurs around worst-case scenarios. Investors experiencing an asset price decline have cash and fixed interest to draw upon through times of trouble.

Some investors do their best to bury their head in the sand and pretend risk does not apply to them. Investors operating without evidence and with no investment philosophy are now receiving a lesson in risk they didn’t price. In these instances, the investors quickly scream about fairness. As if a higher power may take mercy upon them. Unpriced risk is not measured in fairness. It is sharp and it is ruthless.

Property Investors

The modern hang out is an internet forum, chat room or Facebook group. With movement restrictions right now, it’s the only place to hang out. In Australia (and around the world) some property investors are in a serious panic.

Short term stays are flooding the long-term rental pool. Prospective tenants have walked. International students have fled and immigration ground to a halt. Supply up. Demand down. Governments have put a moratorium on evictions. As unpalatable as that move is, it’s a form of legislative risk. The following post on a Facebook group is not uncommon across a variety of platforms.

Financial stress is nothing to be laughed at, but there is some dark humour in this person’s assumption ‘property was supposed to be a safe investment’. The changing rental market conditions and eviction moratorium have created fears of opportunism. Anyone claiming hardship when they can still pay rent should be condemned. On the other side, landlords and property managers have been implying renters should dip into their superannuation savings to pay rent. ASIC would deem this as financial advice and no one should be taking financial advice from their landlord.

The country’s real estate lobby groups have started calling for a monetary package for property investors. Online, landlords are howling their tenants may not have six months of expenses stashed away, something they admit they don’t have themselves. The hit from legislative risk exposes their liquidity risk. We explained the principles that should formulate an investment strategy, yet here we have a group of investors, many using a leveraged speculative strategy, operating with a minimal margin of error, now expecting the government to cover them because they failed to price risk.

Superannuation Funds

Then there’s our country’s superannuation funds. Multiple times we’ve mentioned their flagship balanced funds holding significantly more risk assets than a balanced fund should. It means their performance often looks much better than actual balanced portfolios. Their use of illiquid assets such as property, infrastructure and private equity aren’t subject to the same sort of daily revaluations. This means their performance often looks better in down times too.

As an example, as of March 30, Blackrock’s iShares Global Infrastructure ETF was down 28% this year. In comparison, over at super fund Hostplus, their infrastructure option was down a mere 2.8% this year, as per their valuation on March 27. That type of small write down doesn’t pass the sniff test.

These unlisted assets are now causing some panic within the superfunds themselves. The government, making another sweeping change with the stroke of a pen, saw fit to open up superannuation to unexpected withdrawals. Self-assessed, non-taxed withdrawals from members who’d lost their job or suffered a 20% income decline. The superfunds are demanding the government help to facilitate withdrawals, so they don’t need to liquidate assets in a crunch.

Some funds, led by the union-and-employer-controlled industry sector, want the government to underwrite a “liquidity backstop facility” that would provide immediate cash to pay withdrawals. For-profit funds oppose the idea. There is no suggestion any super fund is at risk of collapse. Rather, industry sources fear that the forced sale of assets would crush their value, crimping returns for people who remain in the fund.

Again, legislative risk and liquidity risk. If anyone should expect legislative risk, it’s the superannuation industry. The decision is a poor one, but we’ve warned about superfunds and their illiquid assets in the event of the worst. The worst happened. There is regular sabre rattling from one side of politics about superannuation funds. The LNP hold a decidedly dim view of superannuation. A cynic might suspect because it was a Labor creation and now the largest superannuation funds in the country have links to their mortal enemies, the unions. Liberal Senator, Andrew Bragg making an opportunistic, but relevant point.

Superannuation funds which may have overextended into illiquid assets, such as infrastructure and property and who did not retain adequate cash and other liquid holdings, did so knowing the risks they were adopting… To tout strong investment returns off the back of illiquid assets in the good years, only to come to the government cap in hand when markets inevitably turn, is simply a sign of bad management and poor investment governance.

If the government doesn’t come to the party, a fund with a high level of unlisted assets has a problem. As do their members. If those illiquid assets aren’t appropriately revalued, the members pulling their money are leaving with an overvalued redemption. This shifts the cost onto members left in the fund. Those in the balanced option are left holding more of the illiquid asset. In the event of a more realistic revaluation, those members take a bigger valuation hit.

Evidence should play a large part when formulating an investment strategy. It helps to understand and price risk. Too often investors and asset managers are cavalier. They dismiss evidence. They speculate and they overcommit to assets without an appropriate buffer in place. In good times they’re boastful of their returns. In bad, they’re banging on the government’s door.

We started off this article with a foray into the world’s oldest profession. It does seem strange that a more complete understanding of risk can be found in a brothel than the minds of many investors. Maybe it takes centuries of lessons, evidence and data to appropriately price risk. Ironically, there are centuries of investment lessons, evidence and data out there. The issue? Not enough investors choose to take advantage.